Globally, wheats can be separated into three very broad end uses. The hard wheats tend to have good dough strength, good elasticity and high proteins (11.5 - 15%) making them ideal for pan breads (loaves), flat breads, steamed buns and noodles. The main Australian classes are APH, AH and APW grades. The US Hard Red Winter and Spring wheat (HRW/HRS) and Canadian Western Spring Red wheat (CWRS) would also fall into the class.

Softer wheats, while still considered milling grade, are characterised by lower protein, weaker dough and gluten strength. End uses are aimed at pastries, biscuits, flat breads and steamed buns. Australian ASW and US Soft Red Wheat (SRW) are good examples of this class. The APW and ASW grades of wheat are both excellent ‘blenders’ in that they are mid protein range, have excellent white flour colour and dough strength. They are often used to bulk up a cargo with smaller quantities of very high protein wheats to cater for specific end uses.

The last grade can roughly be characterised as feed wheats. Broadly speaking, they are not suitable for milling because of an inferior protein count, fungal /colour issues or have weather damage/poor falling numbers. The AGP, SFW, FED classes are Australian examples – although AGP can be blended off into higher quality cargoes. Feed wheat tends to compete with corn into feed rations.

Generally speaking, end users of high-quality wheats usually have a good number of options from which to secure their requirements. German, Baltic and Black Sea wheats generally have around 12-14% protein, US and Canadian HRW and HRS also have excellent quality profiles and are equivalent to the Australian APH/AH classes.

This year however, the milling market is bracing for a shortfall in high protein wheat as weather has taken its toll on global quality. Despite a hot and dry summer, European reports suggest that quality profiles are down 1-2% from average due to late season rainfall. Russia is producing arguably one of their largest wheat crops ever, but similar story to the EU, late season rain is seeing a big percentage (>50%?) of wheat being downgraded to feed.

Canadian farmers have enjoyed a big turn around from last year’s drought affected crop. It is early days in the Canadian harvest, so it is unclear if the higher yields will effectively dilute protein content (typically averages ~15% in the prairies) or if residual soil nutrition after last year’s drought will help keep protein levels up.

Australia too is looking at a lower than average quality profile. Successive years of record yields, compounded by expensive and sometimes, unavailable nitrogen fertilisers. The forecast of a soft finish, has Australia primed for a low average protein count.

The US HRW areas suffered under an unusually bad drought this year so while yields are sub par, protein is not a problem. Similarly the northern HRS areas are also looking at average protein levels with above average yields.

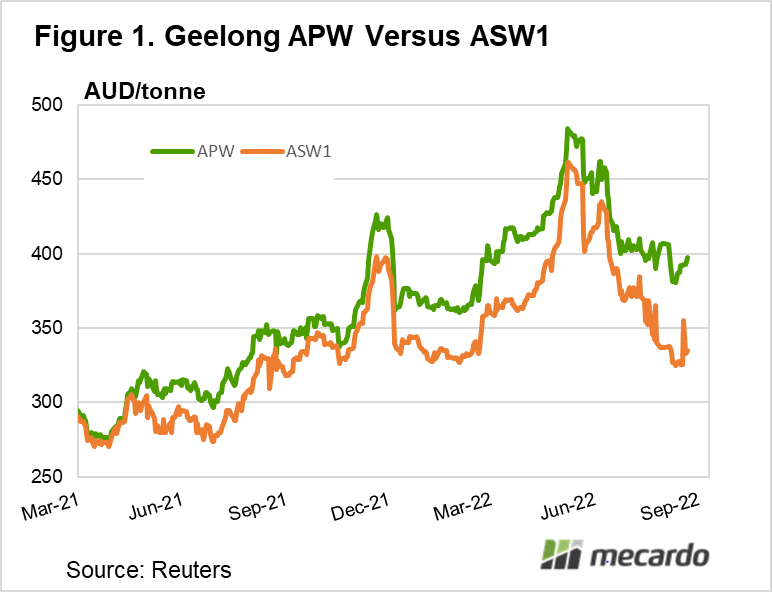

So of the major exporters, 4 out of 5 are forecasting lower protein. We are already seeing spreads widen, both here and internationally, between the high and lower quality wheat grades. In Australia today, the average spread to ASW type wheat on multi grade contracts varies from -$35 in SA, to -$60 in WA and -$40 in NSW. If we see low protein across the board, it is possible that these spreads slip even further. (figure 1)

It is not all bad news though. The past couple of years have also shown us that once the trade have bought their protein needs, wheat spreads tend to level out – wheat becomes wheat – the deeper into harvest you go.

What does it mean?

If we get the soft finish we all hope for, I think it fair to assume there will be a lot of lower protein wheat hitting the market. Anything making APW or higher, should attract a premium especially early during harvest. If spreads for ASW and lower drop significantly, it might pay to warehouse and wait out the harvest surge. Talk to a trusted adviser to help develop a grain marketing strategy.

Have any questions or comments?

Key Points

- 4 out 5 major wheat exporters experiencing protein level downgrades thanks to late rain.

- Spread widening between higher and lower quality wheat grades.

- There may be a surplus of ‘lower quality’ feed grain in Australia this year, storing until the spread closes may be worthwhile.

Click on figure to expand

Data sources: Argus, SovEcon, WQA