The USDA published its April World Agriculture Supply & Demand Estimates (WASDE) report early this week. Global ending stocks of wheat and corn were revised down on strong demand, while a boost to Brazil’s soybean crop saw the USDA lift global soybean ending stocks above expectations.

Summary by Crop

Wheat

- There were two small changes to the US 2020/21 wheat supply and demand forecasts, resulting in projected ending stocks increasing by 16 million bushels.

- Projected global 2020/21 wheat ending stocks were lowered ~5.7 Mmt primarily on higher global feed demand. Estimated global production was little changed this month, however higher consumption was partly supported by increased Russian (+0.5 Mmt) and EU exports (+0.5 Mmt). Of note Chinese wheat feed demand increased by 5 Mmt, as China continues to use large volumes of grains to support the domestic hog industry, drawing down domestic stocks.

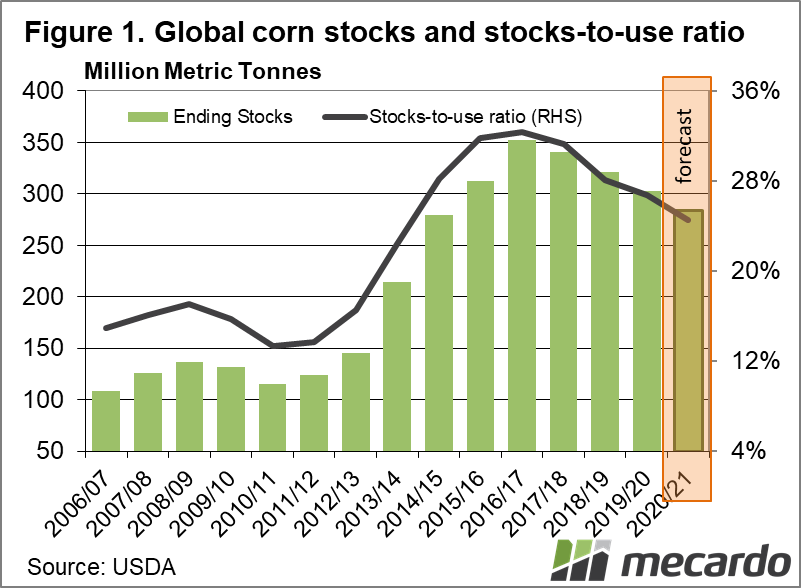

Corn

- The USDA made several changes to projected US corn demand this month. Projected feed and residual use increased 50 million bushels. US projected corn ethanol use was raised by 25 million bushels, on growing ethanol production. US estimated corn exports increased by 75 million bushels. As a result of the forecasted demand changes, projected US corn ending stocks decreased 150 million bushels.

- Global production estimates rose slightly, driven by increased production in the EU, Pakistan and Ecuador, however partially offset by lower production in Argentina (-0.5 Mmt). Projected Ukraine corn exports were lowered (-1 Mmt) based on current export data, however Ukraine’s domestic use increased to offset lower exports, leaving Ukrainian ending stocks relatively unchanged and at historically low levels. Projected global corn ending stocks were lowered ~4 Mmt primarily due to higher global feed demand.

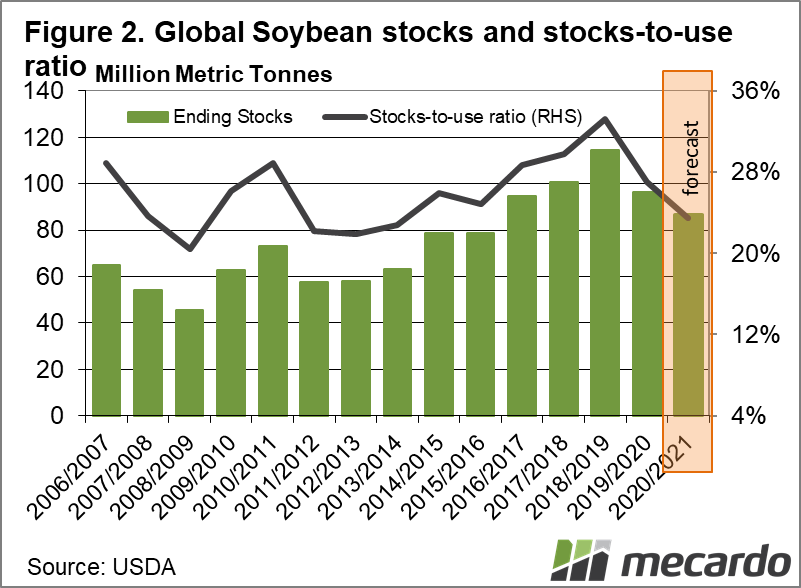

Soybeans

- There were offsetting changes made to the US 2020/21 soybean supply and demand estimates this month resulting in ending stocks remaining unchanged at pipeline minimums of 120 million bushels.

- Projected 2020/21 global ending stocks increased slightly (+3 Mmt) due to increased production estimates, combined with slightly lower global consumption changes. Argentina’s projected production remained unchanged; however, exports were lowered slightly (-0.25 Mmt). Brazil’s projected production increased by 2 Mmt, and exports increased 1 Mmt. China’s soybean crush was lowered (-2 Mmt) on the slower crushing pace in late Q1-2021.

What does it mean?

In the hours post WASDE, spot corn futures were largely unchanged trading at $5.77/bushel, new crop futures rose by ~2 cents to 4.97/bushel. Spot soybean futures fell by ~ 12 cents to $14.03/bushel, with new crop futures falling a similar amount to $12.63/bushel on generally bearish news with US stocks unchanged, increased Brazilian production, and reduced Chinese crush. Although the US data was unsupportive of wheat prices, spot wheat futures rose post-WASDE ~10 cents, likely gaining on the bullish corn data, and tighter global wheat stocks.

Although the 2021 Prospective Planting was released last week, we will have to wait until the May WASDE for estimates of new crop (2021/22) supply and demand.

Have any questions or comments?

Key Points

- Chinese wheat feed demand increased by 5 Mmt, as they continue to use large volumes of grains.

- Global corn ending stocks were lowered by ~4Mmt

- Brazilian soybean crop estimates were increased by 2Mmt.

Click to expand

Click to expand

Data sources: USDA, Nutrien, Mecardo