Oilseeds, and in particular, soybeans, have recently seen a solid rally in prices not seen in competing grains. Global Oilseed supplies are still sitting near record highs, with improving demand the main driver behind the recent rally. The question for Australian growers is whether stronger soybean values will provide some support for canola at local level.

Figure 1 shows how CBOT soybean prices have recently rallied strongly, gaining 6% from the start of March low, to hit a 5 month high of 910¢/bu. The soybean rally has reportedly been driven in part by increasing soybean demand from China.

Chinese soybean acreage has diminished this year, as ‘Chinese Government Officials’ have decided that they are better off importing soybeans, rather than growing them. Corn is seen to offer better margins. As such China is expected to need to import 82mmt of soybeans in 2015-16 to cover domestic needs.

According to the USDA expect China to import 4.7% more soybeans this year, with China accounting for 42% of world soybean imports. To put this into perspective, the entire Australian winter crop (wheat, barley and canola) was 39.5mmt last year, less than half China’s soybean imports.

Canola values have gained some ground thanks to support from soybeans, but unfortunately for Canadian, and Australian growers, the US exchange rate has weakened while soybeans have rallied, meaning canola values haven’t seen the full rise relative to levels earlier in the year. ICE Canola has rallied 5% from the start of March low, but is only at a one month high of $CA471/t.

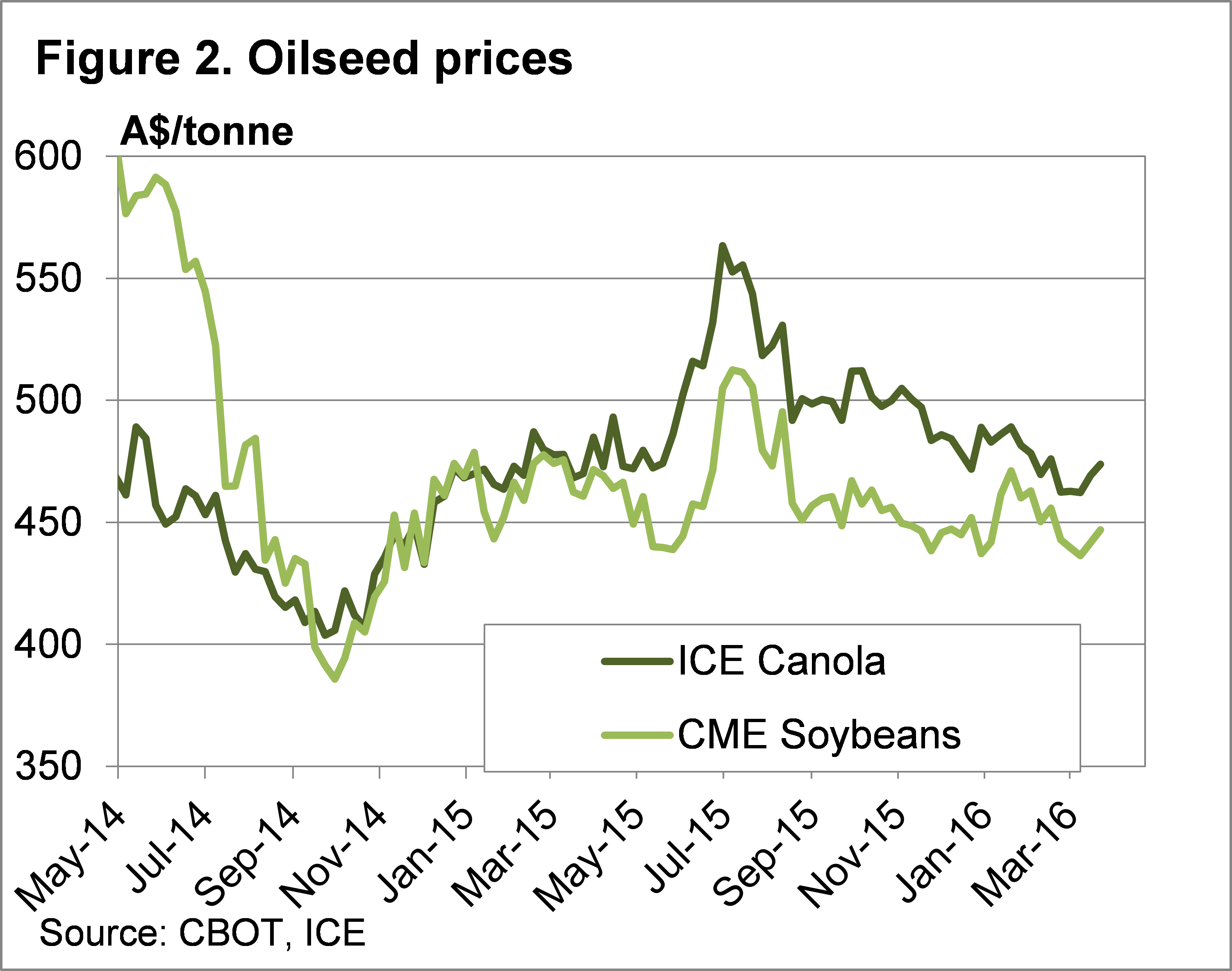

In Aussie dollars per tonne, soybeans and canola have seen a similar rally over the last month (figure 2), but remain at the bottom of the recent range. ICE Canola in our terms is currently sitting at $473/t, down from $490/t at harvest, but most of the weaker price is down to the stronger Aussie dollar and weakening canola values relative to soybeans since late last year.

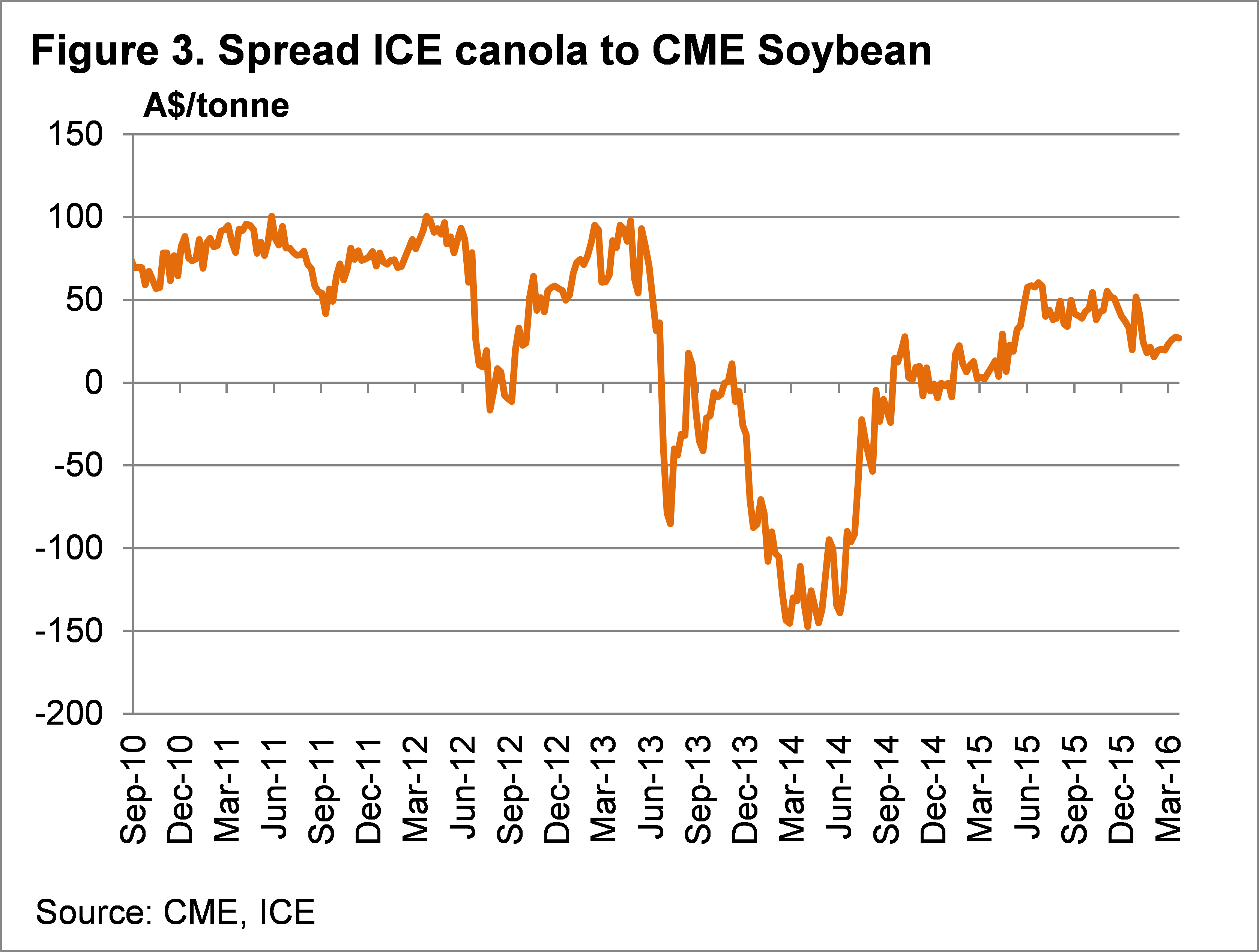

Canola’s premium to soybeans in AUD/t is shown in figure 3, and it is currently close to a 12 month low of $26/t, driven by good supplies out of Canada and the EU. However with canola planting getting underway in Canada, there is plenty of time to see the premium return to $50 with some issues in the early growing season.

What does it mean?

With soybeans at the top of the six month range, upside for canola is more likely to come from a weaker Aussie dollar, and a stronger canola premium relative to soybeans, rather than further increases in soybean values. A return to a similar situation to December in terms of exchange rate and canola premium would see canola swaps in local terms at about $520/t.

A strategy to take advantage of strong soybean values, but leaving the AUD open to falls, and the canola premium open to rises, would be buying soybean put options. A put option on soybeans would see a grower profit if the soybean market fell, but there would be no losses if soybeans continued to rise. There would be a cost in terms of a premium, but this strategy would be likely to payoff through improvement in canola prices, or a fall in soybean values.

Have any questions or comments?

Key Points

- Soybean prices have rallied to a five month high thanks to improving demand for imports from China.

- Canola prices are not as strong due to a stronger AUD and a weaker Canola premium.

- Canola growers can take advantage of stronger soybean prices by buying put options and leaving the AUD and canola premium open.

Click on graph to expand

Click on graph to expand

Click on graph to expand

Data sources: CME, ICE, Mecardo