A couple of weeks ago we took a look at feed grain prices, showing how strong world corn supplies were depressing global feed values, and hence feed grain prices here in Australia. With murmurs of a potential La Nina, it will be US corn and soybean crops that suffer, here we look at how this might create the next big price rally.

The Bureau of Meteorology

has copped a lot of heat in recent times over forecasts of hotter, dryer

conditions in 2023 when for many areas of Australia, mild and wetter conditions

prevailed. Regardless, the BOM is still

the place to find climate forecasts.

The most recent (‘Climate

Driver Update) released last week (read here) shows

the average of international model forecasts are currently sitting at Neutral

for June. We can see that the dial is

swinging back from El Nino toward neutral over the coming four months.

A neutral average

forecast suggests that some models are pointing towards La Nina, and others

remaining in the El Nino range, so it would seem climate forecasts are showing

no real consistency at the moment.

While La Nina

historically produces big crops here, across the Pacific it has the opposite

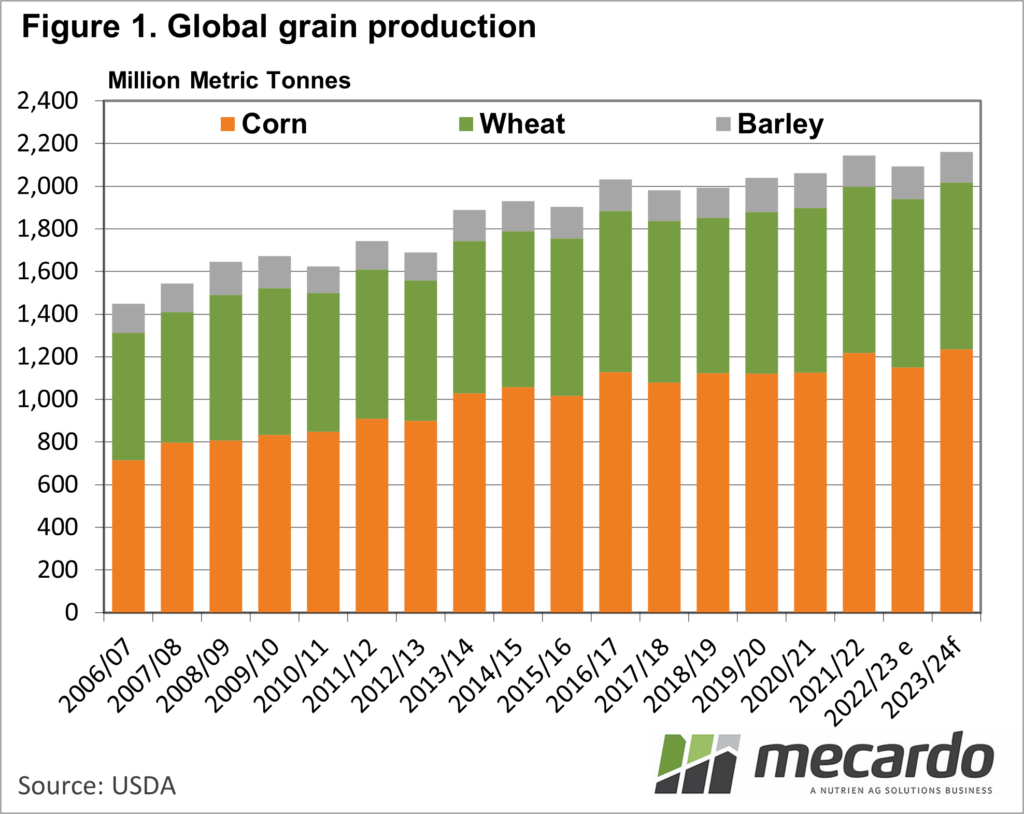

impact. Figure 1 shows global grain

production over the last 18 years. When

La Nina was in action in 2022-23 we can see that global grain production

dropped away from a record high. The

record high was set in a La Nina year though, so like El Nino, the impact is

not consistent or assured.

Argentina, Brazil, and

the US account for 43% of world corn production outside of China. Figure 1 shows corn is the world’s largest

grain crop, and as such impacts prices of all grain commodities.

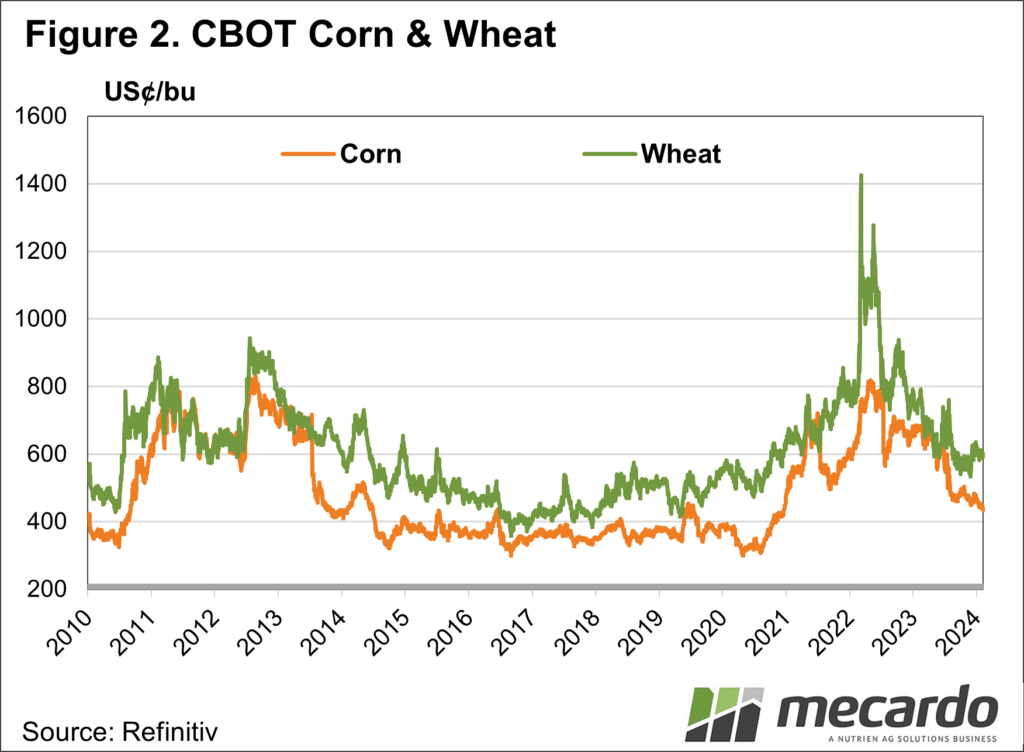

Figure 2 shows corn

and wheat futures contracts with two major corn rallies associated with La Nina

years. From July 2010 to January 2011 corn

prices close to doubled on the back of production declines. We saw a similar rally in August 2020. Even though global corn production remained

steady in the end, ever-increasing consumption saw corn prices more than

double.

What does it mean?

While there is little evidence to suggest a La Nina is coming this year, we can see why markets get jittery at even the mention. Speculators certainly don’t want to be caught short in a La Nina market, while Australian growers, in general, will welcome a boost in world prices, and an associated bumper crop.

Have any questions or comments?

Key Points

- Climate models are pointing towards more neutral conditions in 2024.

- Twice in the last 14 years La Nina has caused corn prices to double.

- US grain markets get jittery at even the mention of La Nina.

Click on figure to expand

Click on figure to expand

Data sources: USDA, CME, Refinitiv, Mecardo