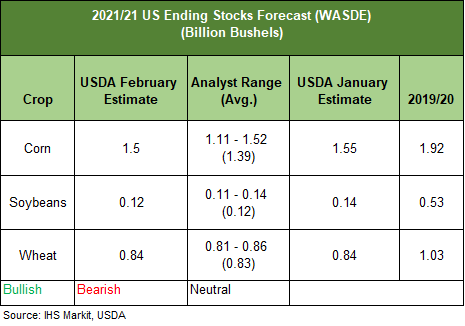

The USDA published its February World Agriculture Supply & Demand Estimates this week and, following the large swings in January, this report seemed rather cautious. Analysts had bullish expectations for this WASDE, based on pre-report forecasts, however the changes were generally in-line or less bullish than projected.

There were no major changes to US production estimates, after large yield changes in January. US exports for corn and soybeans were raised further tightening ending stocks for all three crops.

Summary by Crop

Corn

- The USDA made no changes to projected US corn production for 2020/21. The only change of note to the S&D was a 1.27 Mmt (50 mil bushels) increase to projected US corn exports, and a resulting 1.27 Mmt decrease to projected US ending stocks.

- The global corn stocks to use ratio is now forecast at 10.6% vs 11.0% in the prior WASDE report.

- Global production estimates were raised slightly primarily due to increased area for South Africa (+0.5 Mmt). There were no changes to the Argentine and Brazilian production estimates. Also, of note was the projected increase to Chinese corn imports (+6.5 Mmt) to 24 Mmt, due to their current purchase trend. Corn and other major feedgrains are in high demand in China as they rebuild their hog herd and re-supply domestic stocks.

Soybeans

- There were no changes to projected US soybean production for the 2020/21 market year. The USDA increased forecasted US soybean exports by 20 million bushels and reduced ending stocks by the same amount.

- The US stocks to use ratio is now projected to be 2.6%, which is the lowest since and now equivalent to 2013/14’s stock to use ratio, which was the lowest stocks to use ratio on record.

- Projected 2020/21 global ending stocks are slightly lower (-0.95 Mmt) primarily due to slightly lower beginning stocks and increased consumption. Projected beginning stocks were slightly lower due to some late season exports of old crop soybeans in Argentina and Brazil. However, the USDA made no changes to projected soybean production or exports for both Argentina and Brazil, as rains through the month of January have supported soybean development in South America.

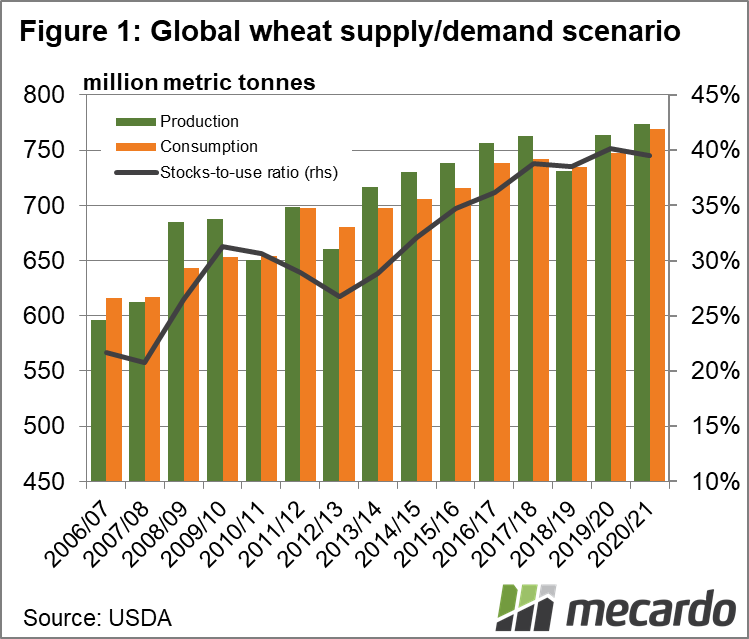

Wheat

- Australian wheat 2020/21 production estimates remained at 30 Mmt. Note, ABARES is estimating production at 31 Mmt.

- There were no major changes to the US wheat supply and demand forecasts.

- Global production estimates were raised slightly (+0.8 Mmt) to a record 773.4 Mmt for the 2020/21 market year. Projected global consumption was raised 9.8 Mmt, mostly due to the higher demand from China for feed grains (which is now at record levels of 30 Mmt), and India’s increased demand for food, seed and industrial purposes. China’s domestic corn prices are extremely high and are at a premium to wheat which has incentivized livestock producers to use more wheat. Projected Chinese wheat imports were raised 1 Mmt to 10 Mmt, while Argentina’s projected wheat exports were lowered 0.5 Mmt due to reduced supplies and growers keeping stocks as a hedge against domestic currency devaluation. Global stocks remain at record highs, with the majority still held in China and India.

What does it mean?

Looking at China’s impressive purchasing history of late, the decrease to US corn ending stocks was smaller than expected. In the hours post WASDE, spot corn futures were down slightly as a result. The USDA suggested that they will be watching for cancelation of corn shipments, but the general consensus is further tightening of stocks is expected. With global demand for feed remaining strong and international pricing strong with it, we will be content with Australian grain pricing going along for the ride.

Have any questions or comments?

Key Points

- Chinese corn imports increased by 6.5 Mmt to 24 Mmt.

- Corn ending stocks above expectations

- Global wheat production estimates were raised slightly (+0.8 Mmt) to a record 773.4 Mmt

Click on graph to expand

Data sources: USDA, IHS Markit, Nutrien, Mecardo