When we talk about cattle pricing we often talk about the average price fetched across the nation, or the eastern states, especially when discussing what may be driving prices because it conveniently reduces complexity. Therefore, we often discuss the EYCI. However, 2020 is the year of the restocker – and there can be considerable variability between the prices paid for cattle between the states.

Economic theory says that in well functioning, efficient commodity markets, given good information availability, there should be little difference between prices between locations for the same product.

The issue with cattle markets and the pricing we see is that all cattle are not the same, particularly for restocking purposes, because they have different genetics & growth potential. The specifications of the cattle indicators we often look at, like the EYCI, also have wide weight ranges (200kg+). The weight of an animal can dictate how much extra weight can be put on when a restocker buys cattle with the intention of turning grass into extra kilos of beef prior to turnoff. As we all know, the smaller, well-bred young cattle will be valued higher by those with intention of restocking because of the greater potential in the animal for weight gain. Good conditions and producer confidence has made 2020 the year of the restocker, and driven prices up for processors by constraining supply.

The sub-indexes that MLA publishes can provide more relevant information and insight into the value of more targeted cattle specifications. Take the state based restocker indicators; these only provide information on a narrower subset of the young cattle market compared to the EYCI, namely steers between 200-280kg.

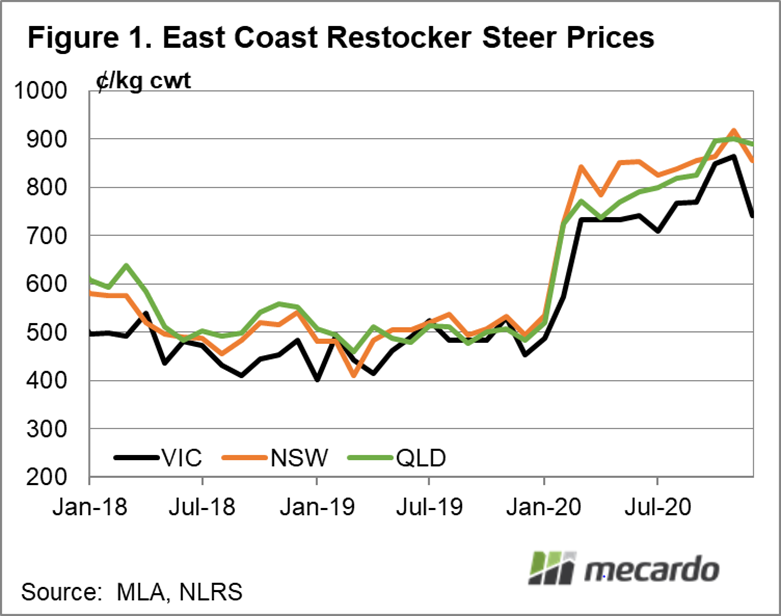

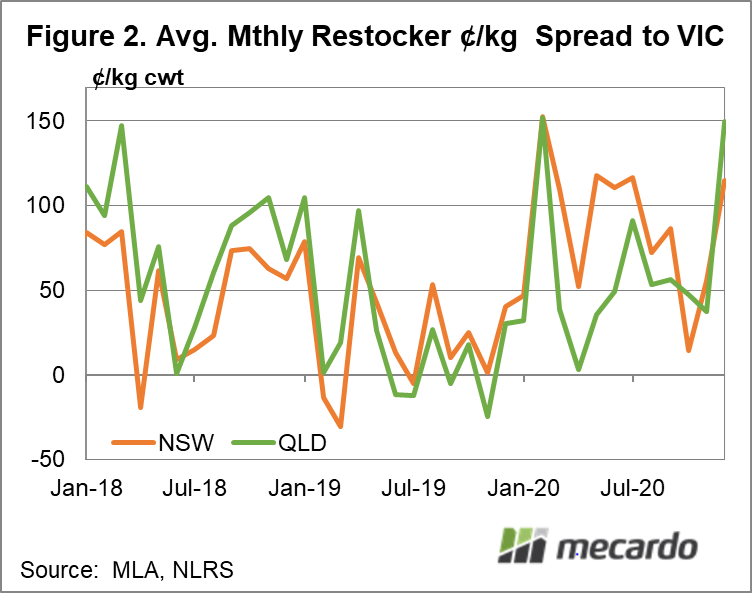

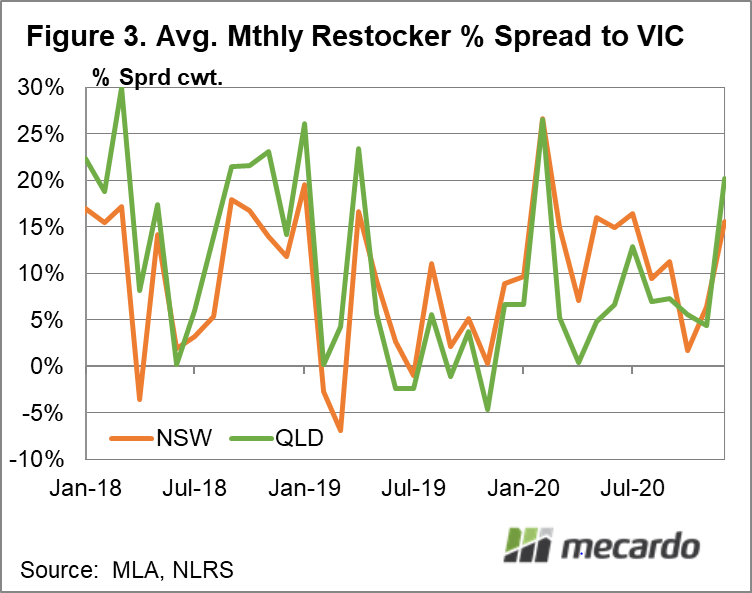

When considering prices in VIC, NSW and QLD, (figure 1) we can see that over the last few years QLD and NSW both attract a significant price premium over VIC. Figure 2 indicates that in the past few years, QLD restocker cattle can trade at over 150¢/kg (cwt) (or 25% – figure 3) above the price in VIC. It also shows that the price spread rarely goes negative, where VIC restocker cattle prices exceed QLD and NSW.

This is possibly suggestive that the strongest restocking demand is generally coming from NSW and QLD, however, the epicentre of that demand clearly fluctuates over time, and is not stable, given that the spread displays significant variability.

Regarding transport costs, the transport NSW livestock loading tool suggests that around 100 ~200-280kg lwt steers can be safely loaded on a B-double truck for long-haul transport. If we assume hauling them 2,000km at $5.50 km, ($11k) we are looking at a minimum cost of 80-105¢/kg cwt for transport from VIC to QLD.

The current average price spread between VIC and QLD is around 150¢, and 115¢ between VIC and NSW, which is indicative that restocking demand in VIC is possibly softer in the south than further north, and that some cattle are potentially moving long distances north, supporting cattle prices further south. The premiums are probably sitting at around the maximum level that is possible before VIC prices begin looking especially cheap after accounting for transport and selling fees, compared to prices in NSW and QLD.

The fact that restocker steer prices persistently operate at a discount to NSW and QLD is suggestive that VIC usually has a relatively more ample supply of young steers compared to demand in the region than the states further north

What does it mean?

The price differential between states for young restocker steers is driven by a combination of what area of Australia demand is primarily emanating from, and the transport costs from more ample sources of supply, to these areas of demand. As such, high premiums in QLD and NSW to a lesser extent, will only be sustained as long as demand remains strong and are probably operating at their maximum level given the cost of transport.

Have any questions or comments?

Key Points

- Restockers in NSW and QLD are usually willing to pay a premium for young cattle compared to in VIC.

- Price spreads between states are typically driven by transport costs, and restocker steer price premiums are currently approaching their theoretical maximum.

- Given that Victorian cattle are much cheaper than in the northern states, this suggests that demand for restocking is stronger in NSW and QLD.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: DAWE, MLA, Mecardo