The Agriculture Victoria Livestock Farm Monitor Project (LFMP) provides an annual snapshot of Victorian cattle, lamb, and wool farmers' performance for the financial year. This year’s report, released in February, showed that in some areas, record cattle prices were offset by record costs.

The LFMP is a benchmarking report that goes through the financials of 124 sheep, beef, and mixed farmers across Victoria. The data, which is divided into the north, southwest, and Gippsland regions, provides great insight into how farms performed for the year, and how it relates to historical profitability.

There is no arguing that 2021-2022 was a good season for cattle producers. Figure 1 shows that the average gross margin for cattle enterprises was more than double that in Northern Victoria. In Western Victoria, gross margins were up 84%, and in Gippsland, (which historically has the best gross margins), gross margins were 54% higher than average.

Driving the higher gross margins was higher prices. Average cattle sale prices for the three regions ranged from $2,300 to $2,500 per head, with the north performing best. Sale prices were up around $400/head year on year for all regions.

Looking at longer-term data, figure 2 shows that Northern Victorian cattle producers had their best year in the 13 years of data, while Gippsland was just eclipsed in 2016-17. Most Western Victorian cattle producers had their best year on record. The spike in gross margins in 2017-18 was caused by one outlying producer who had a massive year. Given the smallish sample sizes, it blew out the average.

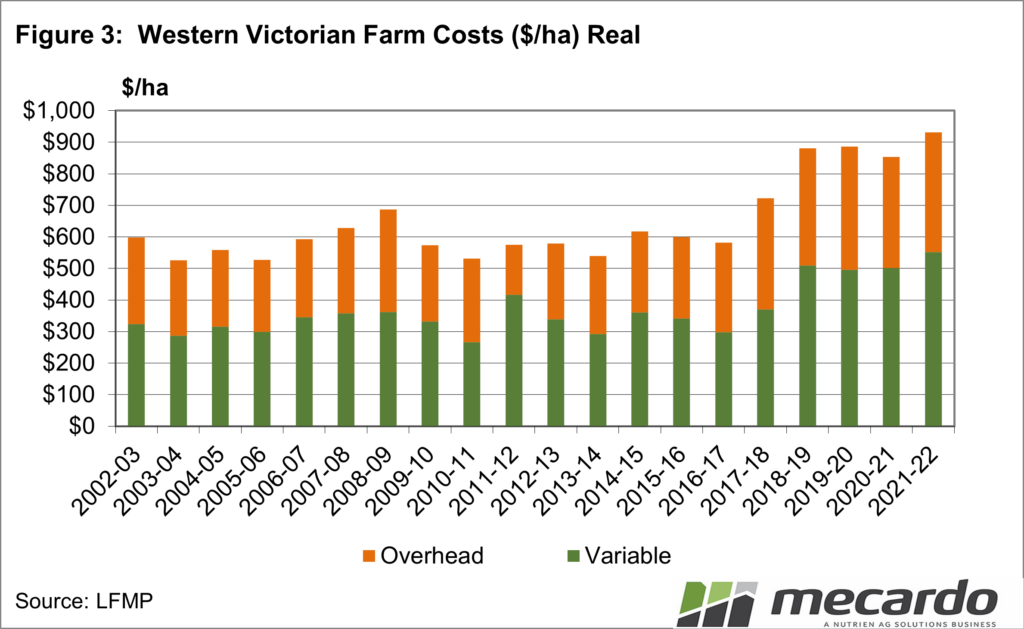

The LFMP also provides historical data on whole farm costs, but it is not broken down into enterprises. Figure 3 shows the variable and overhead cost data for Western Victorian farms.

We would have expected a jump higher in variable costs in 2021-22, but we need to remember that for the data includes sheep and wool producers who didn’t have record prices. The increase in variable costs which came with the better incomes of 2018-19 has continued, with a slight increase in 2021-22.

What does it mean?

It is worth having a look at the LFMP report, it has some great insights, too many to cover here. After a few good years, there is going to be some significant margin adjustment this year with lower cattle prices and high costs stills prevalent.

Have any questions or comments?

Key Points

- The Livestock Farm Monitor Project showed cattle producers had an exceptionally good 2021-22.

- Costs were higher, but increased prices saw very good gross margins.

- This year will likely see a squeeze on margins with lower prices and costs remaining high.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: Agriculture Victoria, LFMP, Mecardo