With a dry winter and spring in many regions in 2023, seasonal conditions are markedly different to a year ago. Wool reflects the conditions it was grown in through fibre diameter, staple length, staple strength, the position of break, vegetable matter and various subjectively assessed faults. Given the change in seasonal conditions, we can expect a change in wool characteristics. In this article, we focus on merino fibre diameter.

Fibre diameter is generally the main influence on value for merino combing wool, although in recent years it has been a big determinant of carding wool prices as well. Swings in fibre diameter, which is normally distributed, have a big influence on the supply of wool on the edge of the distribution (very broad and very fine wool) which in turn affects the relative prices for wool of different fibre diameters.

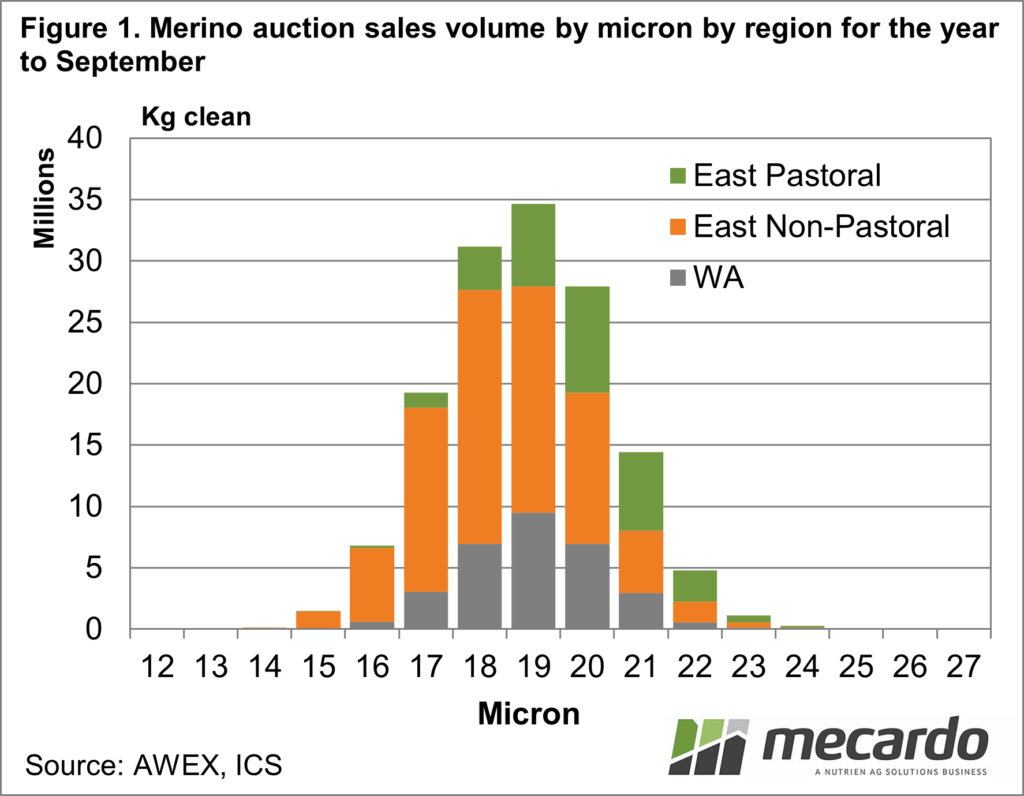

Figure 1 shows the distribution by micron of merino wool sold at Australian auctions during the 12 months to September 2023. The 18 to 20-micron categories are the big categories by volume. The volume for each micron is split by the region it came from. Three regions are used. The first is Western Australia (WA), then the eastern pastoral regions (basically northern South Australia, western NSW, including the western Riverina, and Queensland except Traprock) and eastern non-pastoral (which is everything else in eastern Australia).

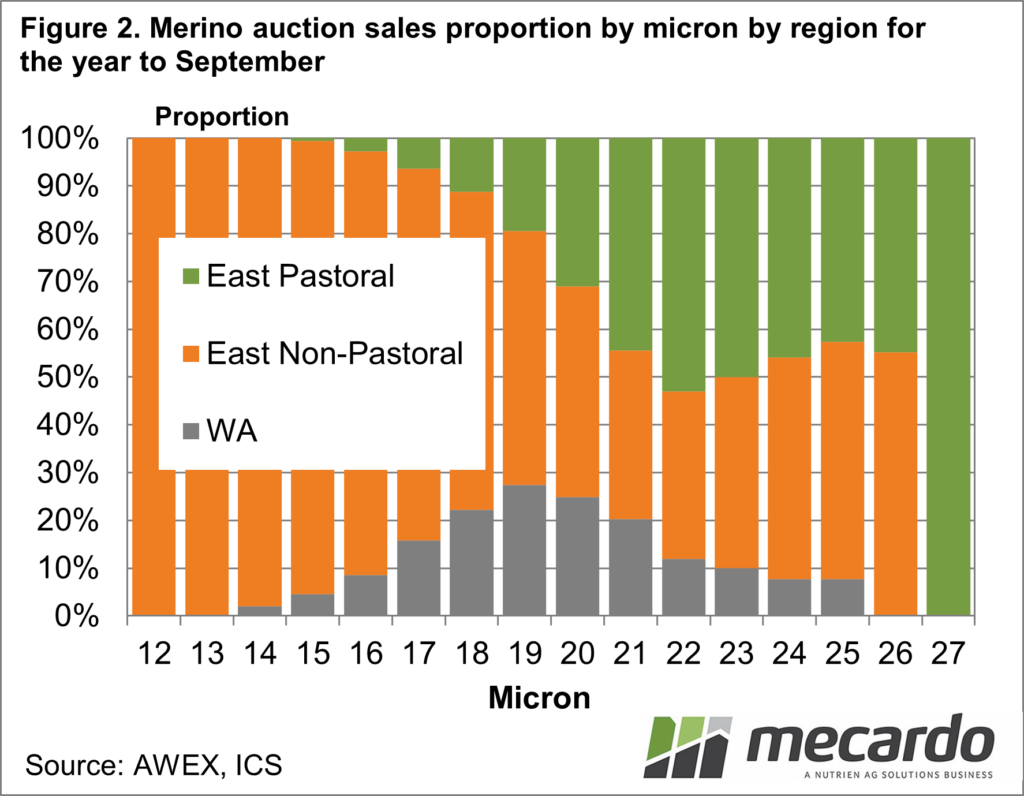

Figure 2 shows the proportion of each micron category which comes from the three regions. It will come as no surprise that wool from the eastern pastoral region is weighted towards wool on the broader side of the merino average, while the eastern non-pastoral region dominates the 17-micron and finer supply with Western Australia sitting in the middle. Figure 2 shows that changes in the quality of wool in these three selected regions will have an impact on different micron categories.

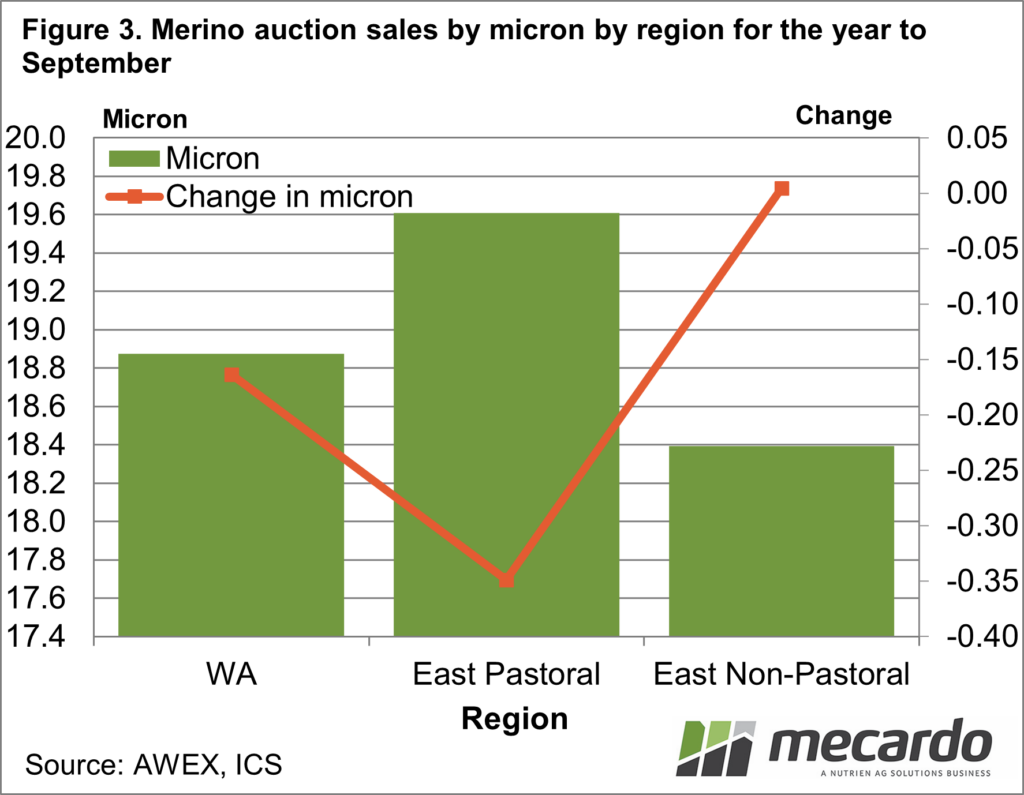

In Figure 3 the Average merino fibre diameter for each region in September is shown (bars) and the year-on-year change in this fibre diameter (line which refers to the right-hand vertical axis). In September the eastern non-pastoral average merino micron was unchanged after it had been gently easing for the past year, while the pastoral merino fibre diameter is some 0.35 micron below year-ago levels. The Western Australian merino micron was down 0.15 micron in September. The marked drop in the pastoral merino clip, which has picked up momentum since mid-year, means there will be a reduction in 20-22 micron wool from the region which accounts for half of the supply of these categories in Australia, with an increase in 17-18 micron volumes where the pastoral region only accounts for around 10% of supply.

The dry spring will catch up with the non-pastoral merino fibre diameter in the second half of the season. However, for the time being, finer wool in Western Australia and in particular in the eastern pastoral regions will pull 20-22 micron volumes lower, which will help support prices for these micron categories.

What does it mean?

Falling supply for 20-22 micron merino wool will help support the prices for these categories in US dollar terms. Normally falling broad merino volumes would be accompanied by complimentary increases in fine merino volumes, but the merino fibre diameter in the eastern non-pastoral region has not been falling by the same degree thereby keeping a lower supply pressure on fine merino premiums than expected.

Have any questions or comments?

Key Points

- A falling merino fibre diameter in the eastern pastoral zone (and to a lesser extent in Western Australia) will push the supply of 20-22 micron merino wool lower in the coming quarters.

- The eastern non-pastoral merino fibre diameter has been gently falling during the past year, and steadied in September, which means there has been less supply pressure on fine merino premiums than expected.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: AWEX, ICS, Mecardo