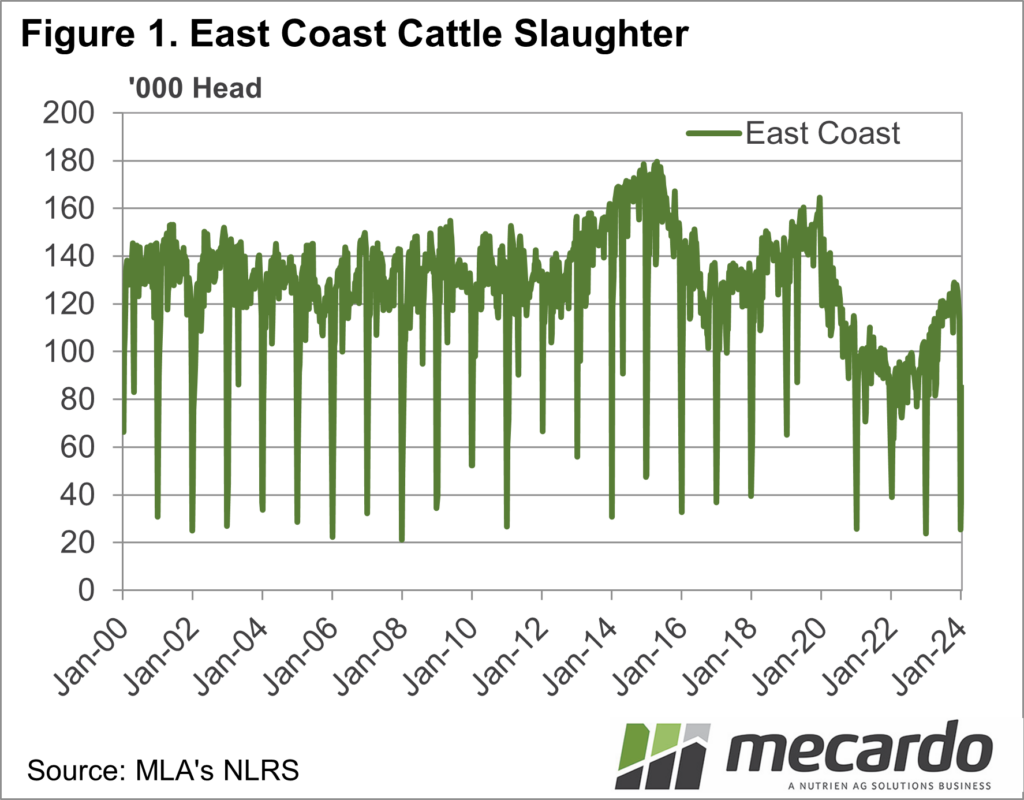

Spring cattle slaughter was much stronger than it had been in recent years, with the herd rebuild waning if not stopping altogether. Compared to the levels of the last 20 years, however, cattle slaughter has some way to go to reach the high tide mark.

Figure 1

shows Meat and Livestock Australia’s weekly cattle slaughter data peaking in

the spring as good margins encouraged increases in slaughter capacity. We all remember the issues there were finding

slaughter space for cattle after tight supply and Covid labour issues drove

cattle slaughter rates to 2022 lows.

The

increases in slaughter were very strong.

From September to the end of December, 472,602 more cattle were

processed than in 2022. This was an

increase of 30% from the lows and the highest level since 2019.

Cattle

slaughter is still well below 2019 levels, and still behind the more steady

state slaughter rates of 2000-2013. With the herd coming from 30-year lows, we

probably can’t expect cattle slaughter to increase any faster.

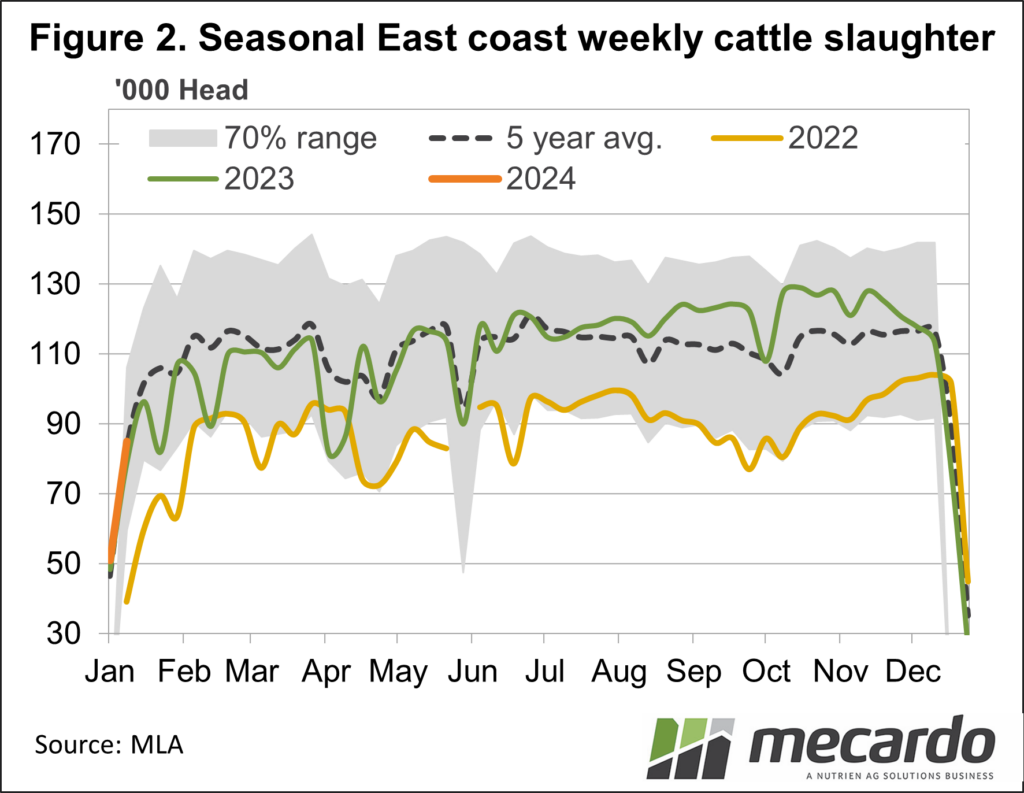

Figure 2

shows cattle slaughter usually opens up a little lower than it finishes, taking

until February to really ramp up. Coming

from the lows, the last two years have seen first-quarter cattle slaughter lower

than winter and spring. Traditionally

the first quarter at least matches the winter.

After the

first few holiday-interrupted weeks we expect to see cattle slaughter move back

somewhere near the five-year average.

However, the price and slaughter levels we saw back in the spring

suggest some cattle that would normally have been carried through might have

been quit early.

Recent

price rises could be due to cattle supply not coming out to meet the increased

slaughter capacity in the new year. We

know export prices are still strong relative to saleyard prices, so any time

when supply wanes is likely to see prices rise.

What does it mean?

There is room for cattle prices to rise, and with increased slaughter capacity compared to last year, we have likely seen the market lows back in the spring. The wet summer in the north should keep a lid on cattle supplies, and likely support cattle prices through the autumn.

Have any questions or comments?

Key Points

- Spring cattle slaughter reached a four-year high, with strong supply and increased capacity.

- Despite very strong year-on-year rises, cattle slaughter remains below historical norms.

- Strong spring slaughter could see tighter supply early in 2024 and prices supported.

Click on figure to expand

Click on figure to expand

Data sources: MLA, Mecardo