The deterioration in the economic backdrop to the greasy wool market points to recession in some of the major economies associated with wool processing and consumption. The implication is that demand for wool (as in the economy generally) will ease and prices follow. This article takes a brief look at cyclical downturns in merino wool prices.

When thinking of commodity prices, it is wise to think of them as cyclical, which means prices both rise and fall. Human nature prefers rising prices. The old saw of commodity prices halving (falling by 50%) and doubling (rising by 100%) as they move through their price cycles is a good one to keep in mind. A rule of thumb which is useful when thinking of wool prices is that wool prices tend to fall by around 35% (give or take 10%) in the first 12-18 months of a down cycle.

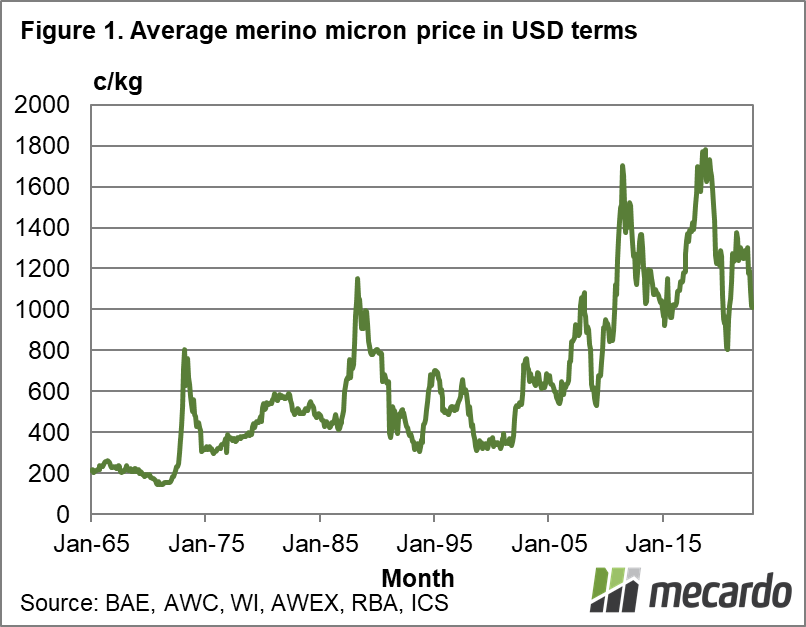

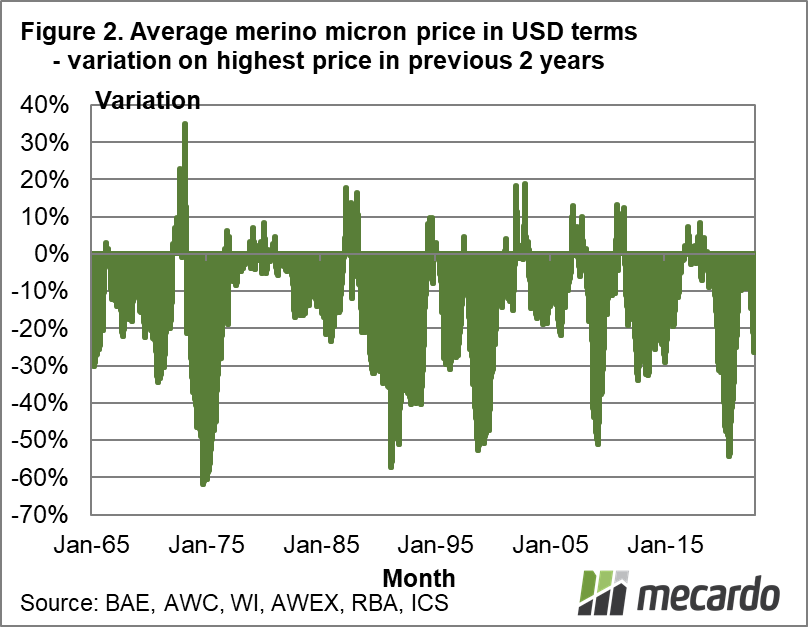

In May 2020 Mecardo looked at the peak to trough variation in merino wool prices, as prices were testing their pandemic lows. Figure 1 shows the average merino price in nominal US dollar terms from the mid-1960s to this month. Figure 2 shows the rolling variation in the US dollar merino price to the highest price of the preceding two years. The lookback period normally used is five years rather than two, but we want the current peak to trough variation to anchor on the 2022 high prices rather than 2018.

In USD terms the rolling two year peak to trough falls in prices have generally been two tiers – 20-30% and around 50%. The pandemic and the financial crisis in 2008-9 pushed the price down by 50%. The current downturn sees the merino price down by 26%, smack in the middle of the first tier downturns.

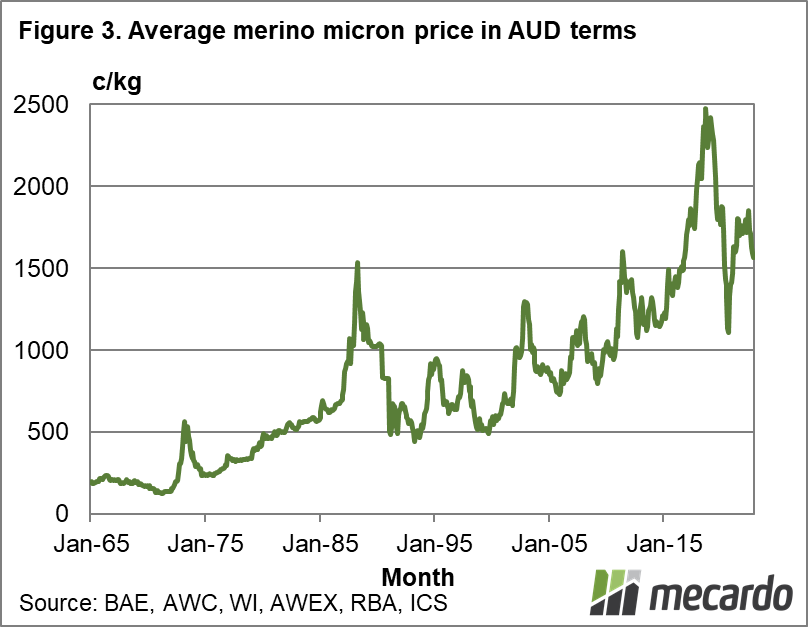

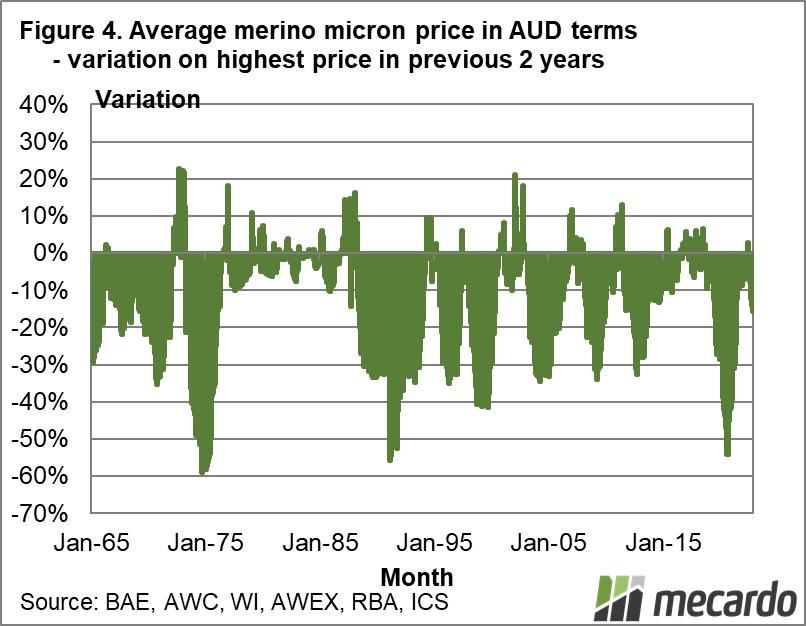

Figures 3 and 4 repeat the exercise in Australian dollar terms, with the floating Australian dollar having an influence on the peak to trough levels. They tend to be evened out to around 30-35%, with a couple of major downturns (the 2020 pandemic, the collapse of the RPS and subsequent recessions, and the mid-1970s) extending to 50-60%. At this stage the merino price in Australian dollar terms is down by 16%, about half of the standard downturn.

In rounded Australian dollar terms the average merino price is down around half of a standard falling cycle (289 cents), with the implication that a full downward cycle will take the price down another 289 cents, from 1565 to 1276 cents. The future rarely plays out exactly according to such projections, but it does give a feel for the price risk currently in the market.

In the mid-1970s and 1990s wool stockpiles amplified the cyclcial downturns in wool prices. This time around merino wool stocks are reported as low along the supply chain. Admittedly there is some nervousness amongst exporters and early stage processors about grower stocks but this nervousness is nearly always there and the stocks will not be that great. The two major down cycles in prices of the past two decades tended to be deep and short in US dollar terms, more even in Australian dollar terms.

What does it mean?

At this stage it appears more price falls are likely, although these will be uneven across the micron categories. The main driver of the cyclical downturn will emanate from slowing economic growth in the major northern hemisphere economies. The supply side of the merino market is in good shape and will not acerbate the down cycle

Have any questions or comments?

Key Points

- In Australian dollar terms the merino price looks to be around halfway along its price fall (from mid-2022 highs).

- In US dollar terms the merino price is close to a “first tier” downturn – around a 30% fall in price.

- If the international economic backdrop to the wool market deteriorates significantly in the next few quarters, then a larger “second tier” cyclical downturn becomes likely.

Click on figure to expand

Click on figure to expand

Data sources: AWEX, ICS