With the World Agricultural Supply and Demand Estimates (WASDE) providing the market with a baseline balance sheet, markets have gone back to shifting in line with weather and geopolitical news. Locally the weather is starting to impact, with the basis on the move.

The re-negotiation of the Black Sea grain corridor provided Chicago Soft Red Wheat the impetus for another move lower last week, and while it has steadied since, the downward trend remains in place.

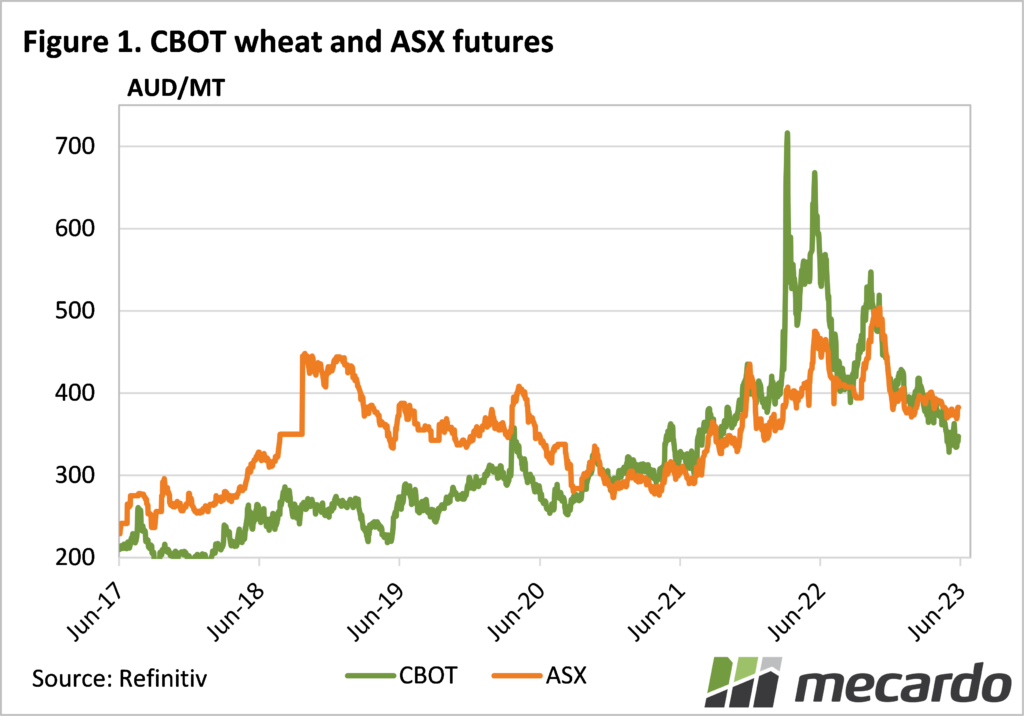

Some of the stats are a little depressing for grain producers. Currently sitting at $345/t in our terms, SRW is around $200/t lower than this time last year. However, as many growers would know, and Figure 1 shows, SRW prices above $300/t are historically not too bad.

The main move we’ve seen in local wheat markets lately is the improvement in the Australian price relative to SRW, or the ‘basis’. ASX Jan 24 futures have been easing over the last two months, falling from close to $400/t to the low $370s a fortnight ago.

Over the last couple of weeks, moisture conditions have continued to deteriorate, and forecasts are not all that promising. When selling dries up in Australia, it pushes prices higher relative to SRW, as there is always underlying demand for wheat.

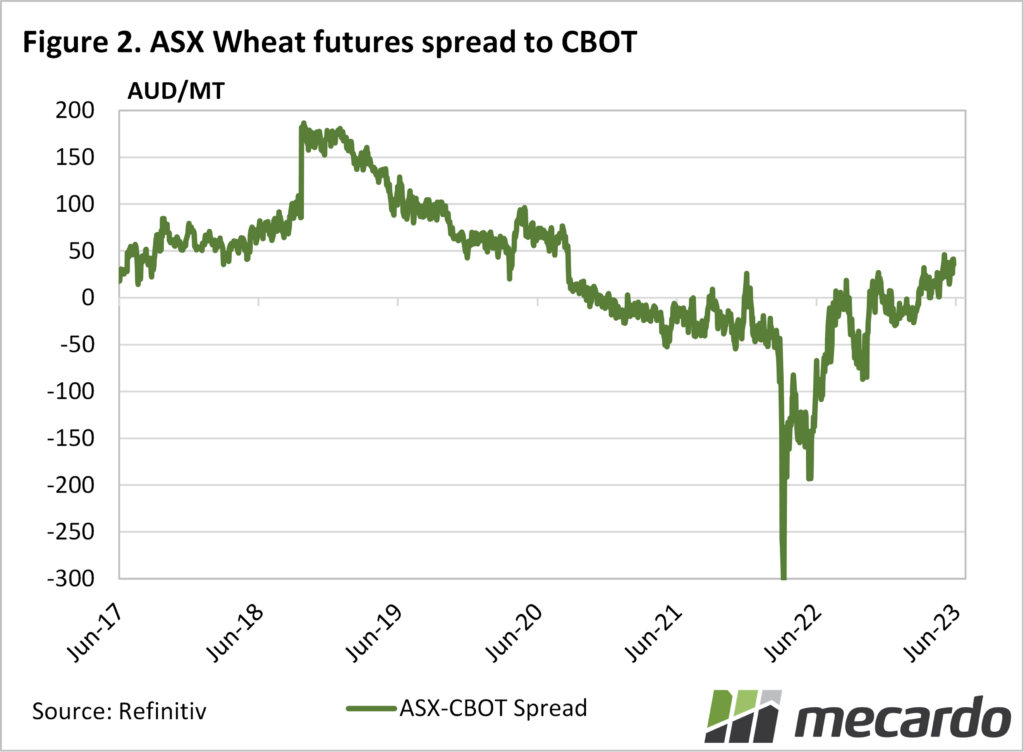

Figure 2 shows ASX spot wheat basis has rallied to over $40/t, the highest level since August 2020. It’s a testament to export programs to think wheat basis can rally as it has after two record crops in a row.

New crop ASX futures last traded at $395/t, which is around a $30 premium to December 23 SRW. This is the sort of level we would expect with a smaller-than-average crop, but obviously nowhere near import parity.

If an El Niño eventuates, and it sends Australian wheat production towards 20mmt we can expect further improvement in basis. Figure 2 shows that north of $50 is easily reached, but to get to levels above $100/t we would have to see drought conditions through winter and spring.

What does it mean?

The improvement in basis has been surprising, and it tends to sneak up when it comes as a result of steady local prices and falling SRW. With crop prospects diminishing, sellers are likely to hold out of markets, while buyers will start looking to protect against the upside.

Consumers that are concerned might do well to protect against price rises using ASX Futures or physical pricing. We have seen plenty of times in the last 20 years, once the horse has bolted on basis, it takes some time to reign in.

Have any questions or comments?

Key Points

- International wheat prices remain on a downward trend.

- Local wheat prices have steadied in the last month, improving basis.

- Consumers concerned about El Niño and higher basis can protect upside using futures.

Click on figure to expand

Click on figure to expand

Data sources: CME, ASX, WASDE, Mecardo