Last October Mecardo looked at the goat market from a big picture perspective. In this week’s article we look at goat meat prices as part of the red meat complex and where the goat meat price sits.

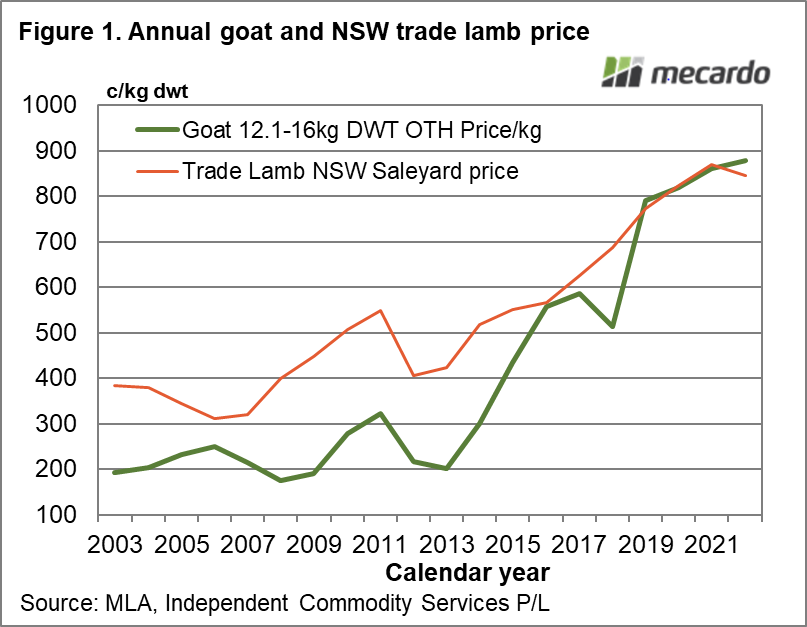

Goat meat prices have trended higher since 2013, tripling to quadrupling in cents per kg terms between 2013 and 2019. Figure 1 shows annual average prices for trade lamb and goat meat from 2003 through to 2022 (January-February only). Between 2003 and 2014 the goat meat price fluctuated between 200 and 300 cents per kg dwt. From 2013-2014 onwards the goat price trended higher, as did the trade lamb price albeit at a slower rate.

Another way of looking at the goat price is to view it in relation to its larger red meat “cousin”, lamb. Basically goat meat production has varied between 3% and 7% of lamb production, so lamb is well and truly the “senior” red meat, as it is to mutton. John Francis’ research paper from 2020 (published by MLA) showed that goats are profitable in the rangelands, not in the medium to higher rainfall zones, which means the supply of goat meat, will be constrained in Australia as the carrying capacity of the rangelands is itself constrained by rainfall. Lamb therefore will remain the dominant small ruminant red meat.

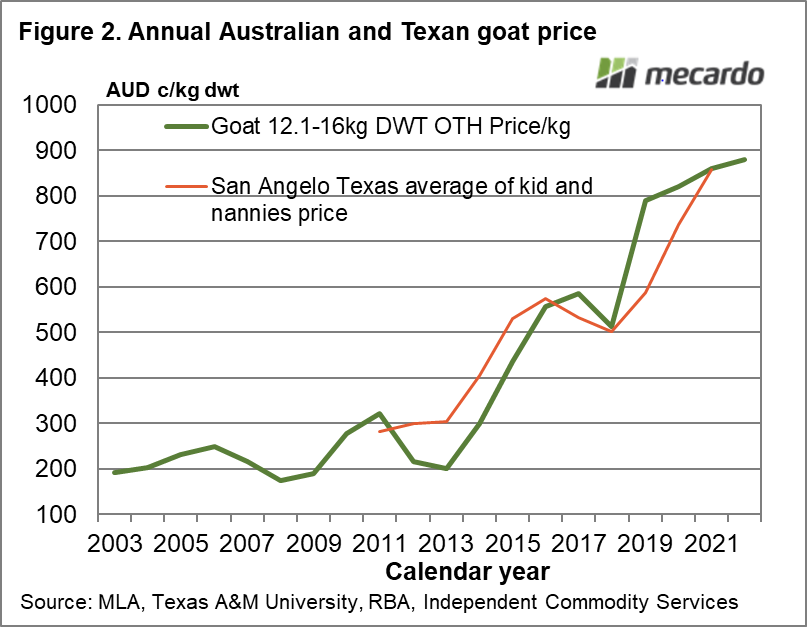

The October article last year showed that the USA was the main export market for Australian goat meat. In Figure 2 the Australian goat meat price series from Figure 1 is compared to an average series from San Angelo in Texas (where a lot of the American meat goats are). The rise in the Australian price series is matched by the US series, so it seems reasonable to assume the key US export market has driven the increase in goat meat price.

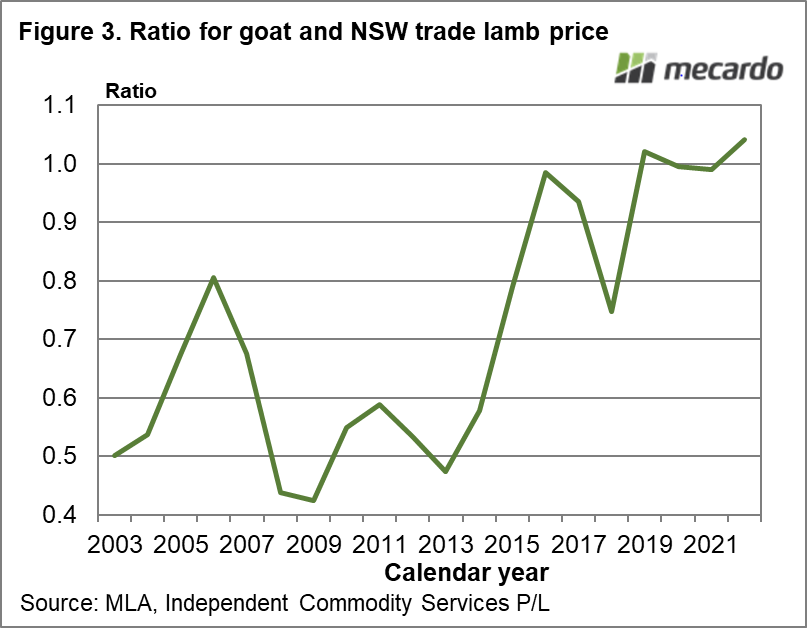

How high can the goat meat price rise? Figure 3 takes the goat price series and expresses it as a proportion of the NSW trade lamb series from 2003 through to 2022 (to date). In the twelve years to 2014 the goat price averages 0.56 of the trade lamb price, albeit varying quite widely. Since 2015 goat meat has averages 0.94 of the trade lamb price, a significant step up in basis, with a price around parity with trade lamb seemingly the upper limit for goat. The underlying assumptions for this statement are that there is a level of substitutability between goat and lamb at the retail level and that the international price linkages shown here for goat also apply to lamb.

What does it mean?

The increase in the goat meat price basis to lamb, good news to goat producers, looks to have hit is limit by reaching parity with the lamb price. History might prove this view wrong but the underlying assumption is that substitution will keep sheep and goat meat prices close. For goat producers this means that the outlook for the lamb market becomes of interest, as it will provide the upper bound for goat meat prices.

Have any questions or comments?

Key Points

- The price of goat meat has gone from averaging 0.56 of the trade lamb price to averaging 0.94 of the trade lamb price.

- The rise in the Australian goat meat price mirrors the rise seen in US goat meat prices.

- For the goat meat market the lamb price now seems to be the upper bound in price – where goes the much bigger lamb market so will follow the goat meat market.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources:

MLA, Francis, Texas A&M University, RBA, ICS