When the world wants to know the supply and demand balance in grain markets, they look to the United States Department of Agriculture (USDA) World Agricultural Supply and Demand Estimates (WASDE). On Friday the WASDE was released, and some big swings in production brought more volatility in prices.

The August WASDE release continued the recent trend of easing supply tensions for wheat, if only marginally. Eight million tonnes of wheat is a lot, being 25% of Australia’s expected 2022-23 production. The USDA lifted it’s world wheat production forecast by 8mmt, but on the grander scale it is only a 1% increase.

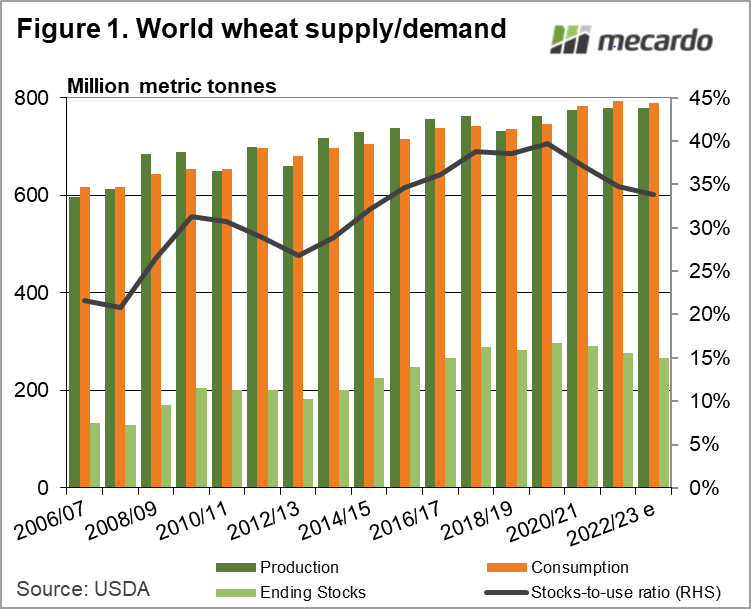

Russia and Australia were the main area which contributed to the increase in wheat production. Global wheat consumption was also lifted, but by a bit less, at 5mmt. Figure 1 shows that despite the increase in production, 2022-23 will be the third year in a row where consumption has outstripped production.

Obviously, more consumption than production leads to a fall in ending stocks, which are forecast at 267mmt. It has been seven years since ending stocks have been this low, and the stocks to use ratio has been below 34%.

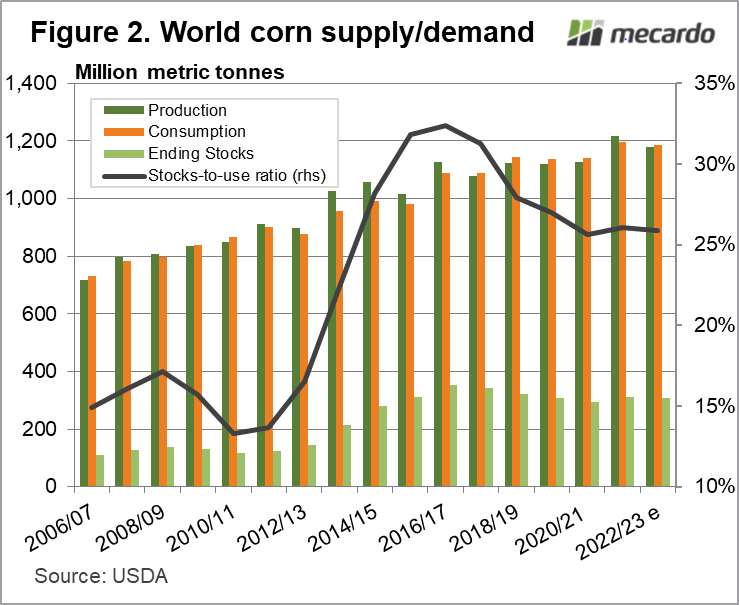

In terms of feed grain, corn is the global leader. Figure 2 shows that the world produces 1.5 times more corn than wheat, and after a record yield in 2021-22, production is forecast to fall back. The August WASDE decreased world corn production forecasts marginally, down 0.5%, but it will still be the second highest crop on record.

There were relatively large cuts in corn production forecasts in the EU, down 12%, and the US, down 1%. This was partially offset by a 5mmt increase from Ukraine.

Corn consumption is forecast to outstrip production, but only marginally, leaving ending stocks and the stocks to use ratio relatively steady on 2021-22.

World oilseed production was forecast marginally higher in 2022-23 for August, but is expected to be 7.5% higher than 2021-22, and at record levels.

What does it mean?

Wheat prices fell after the release of the WASDE report, but remains in the range it has traded for the last month. With wheat prices similar to ‘pre-war’ values, some upside remains possible with supplies a little tighter this year when the northern hemisphere harvest pressure eases.

The feed grain story is similar, with little year on year change in supplies, but plenty of uncertainty around production.

Have any questions or comments?

Key Points

- The WASDE report lifted forecast wheat production, but stocks are still expected to decline.

- World corn supplies should be similar this year, but there is plenty of uncertainty.

- Prices are pegged at similar levels to last year, with upside possible due to volatility.

Click on figure to expand

Click on figure to expand

Data sources: USDA