As we move towards recess for wool markets, and what should be near the peak of the lamb market for the year, it’s time for another look at relative prices. Has the rally in wool markets been enough to see more Merino joinings next year or save some wethers from the market?

The last fortnight has seen wool prices ease off highs, but they are still much better than this time last year. We should clarify a little, fine wool prices are much stronger, with the 19 MPG up 36% while the 21 MPG is 8% higher. For the sake of this analysis, we’ll use 19 MPG prices, as there are more 19 micron Merinos than any other.

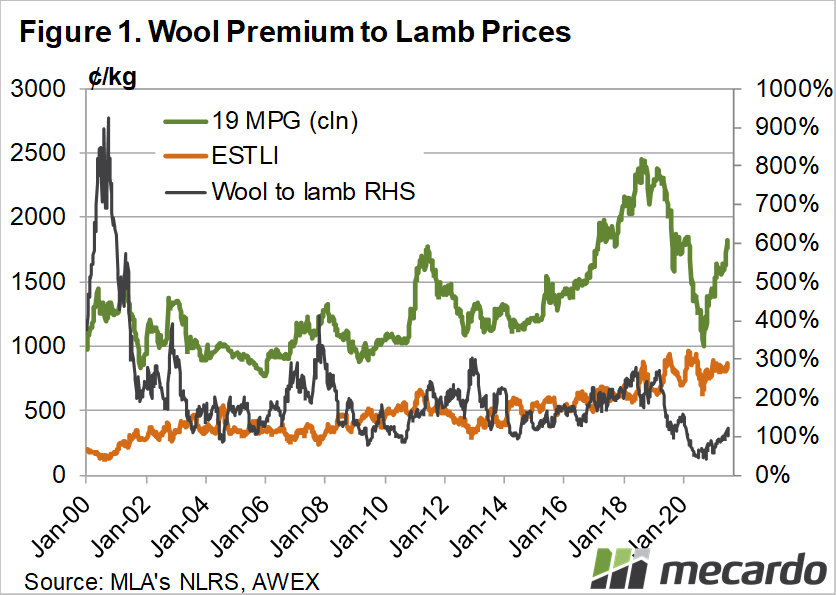

Since the Covid inspired wool price crash we have shown figure 1 a few times. It shows the 19MPG wool prices, the Eastern States Trade Lamb Indicator (ESTLI) and the wool premium to lamb. The wool premium to lamb is a very rough proxy for the relative profitabilities of wool and lamb enterprises.

The higher the wool price relative to lamb, the more profitable a wool enterprise will be compared to a pure lamb production business.

The 19 MPG fell to just a 44% premium to the ESTLI in October 2020, having fallen from highs just above 250% in March 2019. Since the low last October, the rising wool price and relatively steady lamb price, has seen the 19 MPG premium move back above 100%, getting to 120% but falling back to 103% last week.

Figure 1 shows that despite the solid improvement in wool prices and the wool premium to lamb, it remains at the bottom of the historical range.

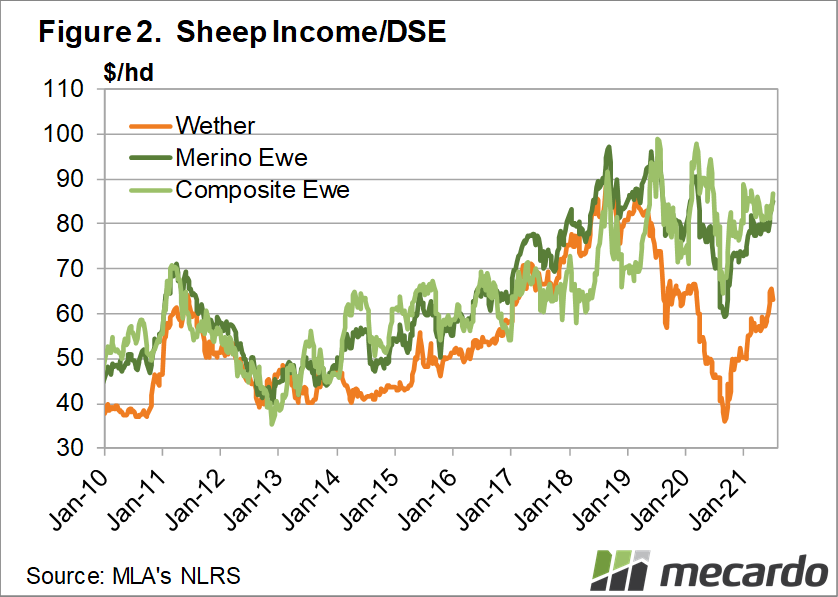

To see how the relative prices affect enterprise income we need to make some assumptions. For wethers we are assuming they are 1 dry sheep equivalent (DSE), and they cut 3.6kgs clean 19 micron wool. Merino ewes are 1.5 DSE, cut 3.25 kgs of wool, and produce 0.7 lambs at 12.6kgs cwt. Composite ewes are 2 DSE, produce 2.65 kgs of 32 micron wool, and 1.25 lambs weaned at 15.4 kgs cwt.

Figure 2 shows the change in income per DSE over time for the three enterprises, and wethers are still lagging well behind.

What does it mean?

Wether annual income per DSE has improved markedly with the rise in wool prices, but with lamb prices remaining very strong, wethers income can’t get near ewe income. Obviously costs for wethers are a lot lower, and from 2017 to 2020, they were a very good enterprise.

At current income levels, it’s hard to see too many Merino wethers making it past the lamb stage. Finer wool is at a better premium, and sub 18 micron wethers might have a chance. In general, wool prices might need to improve further to encourage the expansion of wool enterprises where meat sheep are an option.

Have any questions or comments?

Key Points

- Wool prices have improved but remain at a lower than normal premium to lamb values.

- Wether incomes have risen markedly, but lamb and Merino ewe incomes are well in front.

- There is likely going to have to be further increases in wool prices for strong Merino flock expansion.

Click to expand

Click to expand

Data sources: MLA, Mecardo