With all the volatility in grain markets at the moment it’s hard to get a handle on today’s pricing, let alone new crop. You would hope that by the end of the year the market will have settled a bit, and we return to more normal pricing relationships. Here we take a look at what feed consumers should be putting in their new crop budgets.

Feed grain prices in Australia have two main drivers. There is the world feed market, as, in a good year, over 60% of barley production is exported. There is plenty of feed wheat exported as well, and as such feed grains have to be priced at competitive levels to find buyers.

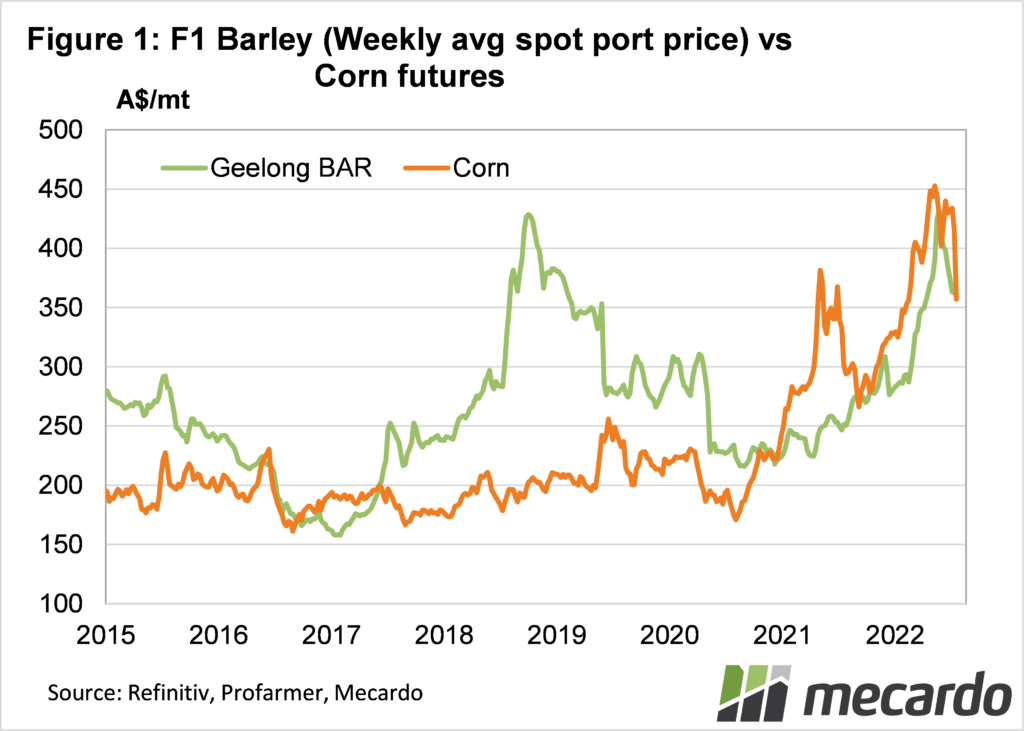

Corn is the world’s biggest feed grain, in terms of traded volume, and the US is the world’s biggest producer. There are swings in price spreads according to production levels in different countries, but we do know that when we have a lot of feed grain to sell, it can’t be priced much higher than US corn.

Figure 1 shows the price of CME Corn Futures along with feed barley at Geelong. Strong local price premiums exist during drought years, when local supply is low, and demand is strong. Little feed is exported in these years. In strong harvests, like the last two, barley trades at a discount to corn.

The recent fall in corn prices has been largely matched by local barley. We still have a large amount to export, and another good harvest appears to be on the way.

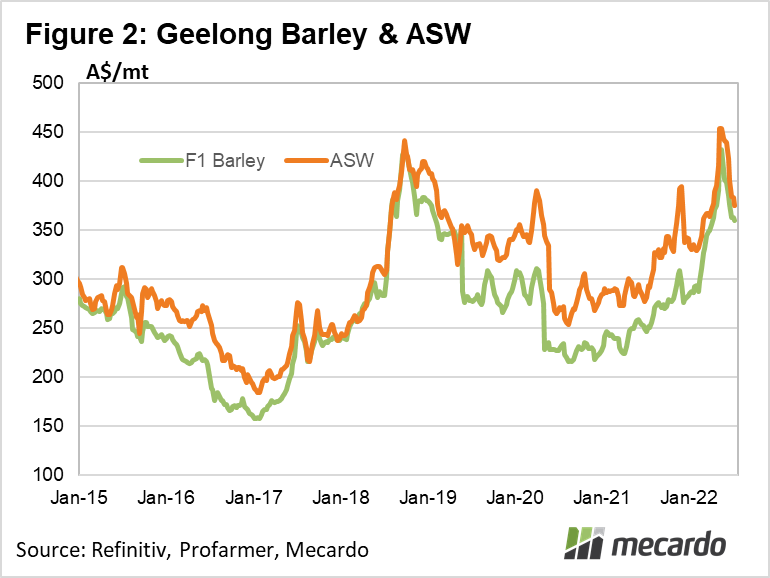

The other driver of local feed grain prices is wheat values (figure 2). In the short term the relationship is governed by local supply and demand milling and feed wheats. When supplies of feed grain, and grain in general, is tight, feed varieties can trade at close to parity with milling grades. At other times spread can be up to $100/t, but usually sit in the $20-60/t range.

New crop barley is current priced around $360/t at port, CME Dec-22 Corn is at $357/t in our terms, and ASW wheat is $375/t at Geelong.

What does it mean?

The Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) is forecasting another large exportable surplus of barley this year, along with strong wheat exports. The current port price of barley at $360/t looks a bit high relative to both corn and wheat in a strong production year.

Grain consumers can manage upside in feed prices by using futures or swaps on either ASX wheat or CME corn, as there is potential for new crop feed grain prices to fall relative to both, which would result is a net grain price less than $360/t.

Have any questions or comments?

Key Points

- Feed grain prices have been just as volatile as milling grades, having fallen in line with international markets.

- New crop barley is currently relatively expensive compared to milling wheat and corn.

- Consumers can start managing feed grain prices using corn swaps or ASX wheat futures.

Click on figure to expand

Click on figure to expand

Data sources: Refinitiv, Profarmer, CME, Mecardo.