The Coronavirus has seen plenty of volatility hit all markets, and wool and livestock have not been immune. Wool has copped the brunt of the fall, while sheepmeat values have largely held their ground. The flock rebuild is on, but the spreads between meat and merino wool might influence what sort of sheep are added to the flock.

Wool prices have tanked in the last month, losing 18% to hit a three and a half year low. Wool prices are inherently cyclical, and this has once again been proven, with some help from the Covid-19 crisis. Supply hasn’t increased, but demand has evaporated.

Lamb and sheepmeat prices are less impacted by cycles, with consistently improving demand seen over the last 8 years. Lamb demand may weaken with the Covid-19 crisis, but tight supply is currently seeing prices hold firm.

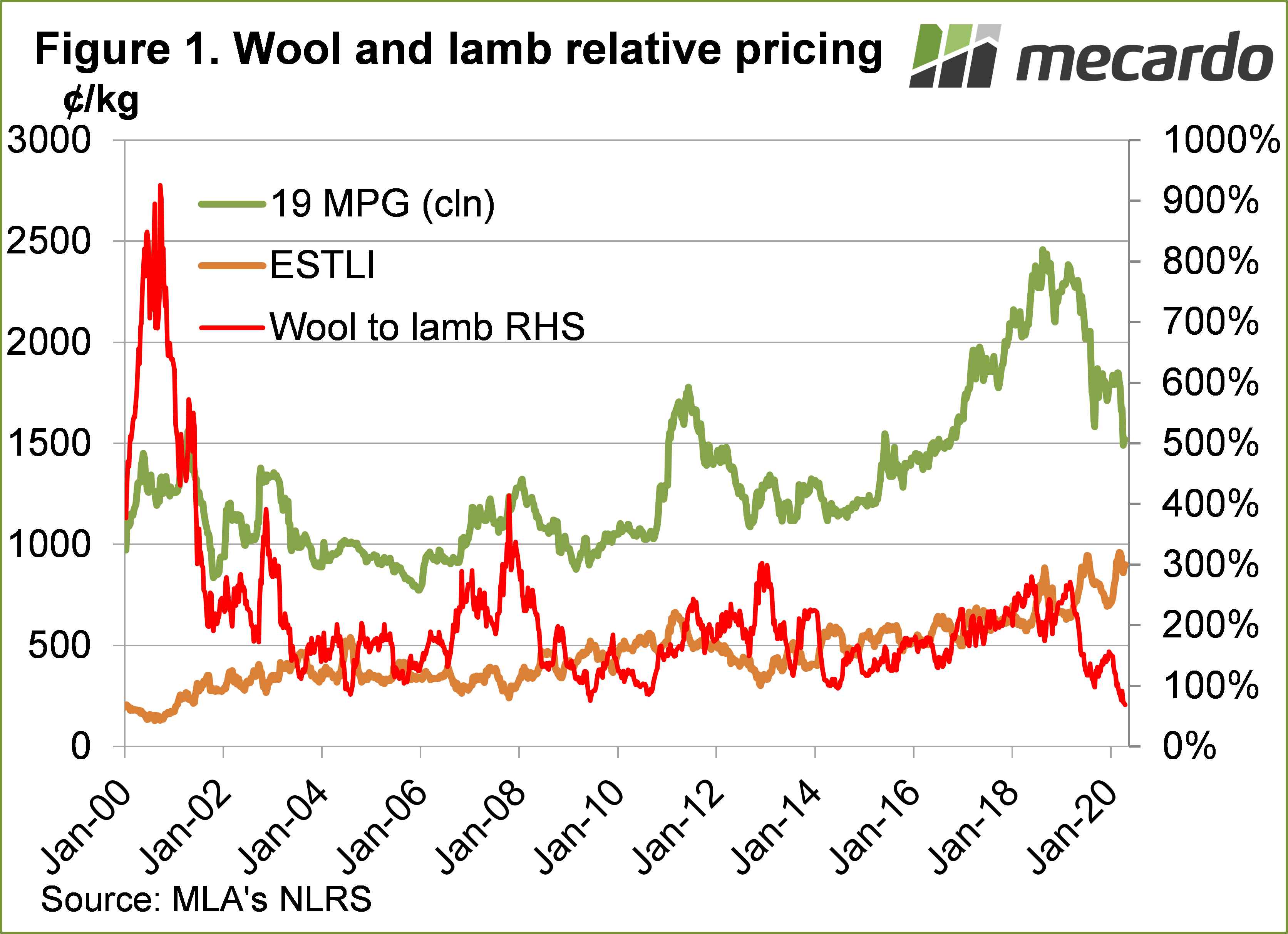

The difference in recent price movements has seen an all-time low reached for fine merino wool prices relative to the Eastern States Trade Lamb Indicator (ESTLI). Figure 1 shows the Southern 19 Micron Price Guide (MPG) and the ESTLI, and the 19 MPG premium over the ESTLI in percentage terms.

We had to estimate the ESTLI for recent weeks, but the results are unlikely to change much. Last week the 19 MPG was at just a 69% premium to the ESTLI, the lowest relative level on record. It has been rare for the 19 MPG to be lower than double the ESTLI, while in 2019 the average was 173%.

The 10 and 20 year averages are both between 170 and 180%, which has been enough to see the decline of the merino wether, and to a lesser extent merino ewes. Crossbred sheep have replaced merinos, and the current dynamic is likely to see this continue.

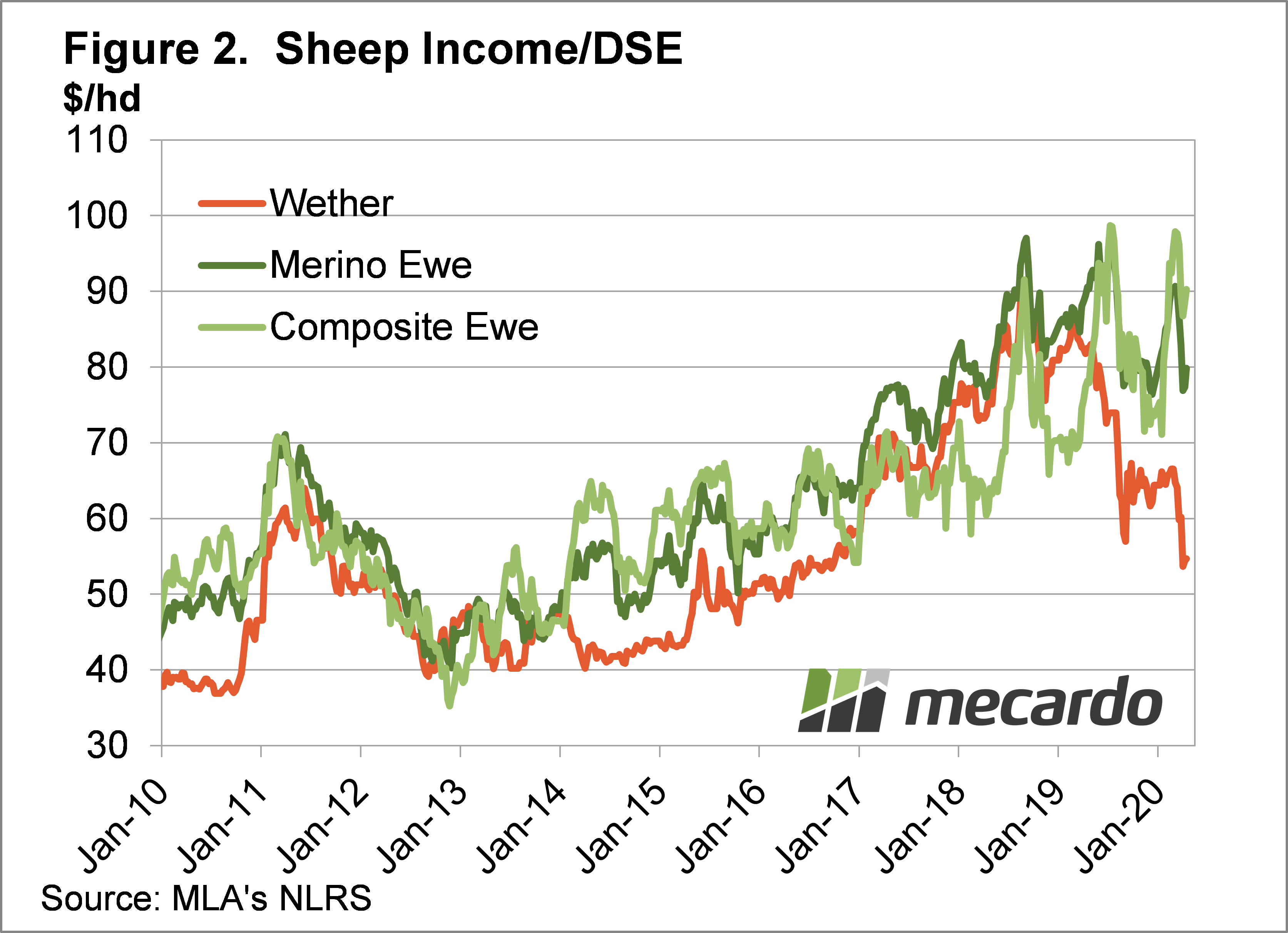

Figure 2 shows how relative prices affect modelled income per DSE. The model uses 5kgs of 19 micron wool with 72% yield for wethers, which are 1 DSE. For merino ewes, the numbers are based 4.5kgs of 19 micron wool, and 0.7 lambs weaned at 30kgs at 1.5 DSE. We know a lot of merino producers do better than this but this is the national average. Crossbred ewes are producing 4kgs of 32 micron wool yielding 66% and 1.25 lambs weighing 35kgs, but they equate to 2 DSE.

There is little arguing with merino wethers having record low income compared to both merino and composite ewes. Merino ewes meanwhile have rarely had income more than $10 per DSE lower than crossbred ewes, but that is where it sits now.

What does it mean?

With merino wethers making well over $150 per head, it will be hard to justify holding onto them for the wool cut this year. Abundant feed in areas recovering from drought will help, but if the price spreads between wool and sheepmeat persist it will continue, and possibly accelerate, the move towards dual purpose or meat sheep at the expense of fine wool merinos.

A majority of joinings had taken place before Covid-19 hit, as we aren’t going to see impacts on flock structure, and lamb supplies until next year. The lower wool price might help support sheep supplies however, which are expected to be very tight this year.

Have any questions or comments?

Key Points

- Covid-19 has seen the fall in wool prices accelerate, while sheepmeat values are still strong

- The 19 MPG is at all-time lows relative to the ESTLI

- Low returns from wool might see a renewed push to dual purpose and crossbred sheep

Click on graph to expand

Click on graph to expand

Data sources: MLA, NLRS