The Australian Bureau of Agricultural and Resource Economics (ABARES) released its March Crop Report last week, and we had our first look at the 2023-24 crop. After three massive crops in a row, it’s no surprise to see a significant drop in production estimates.

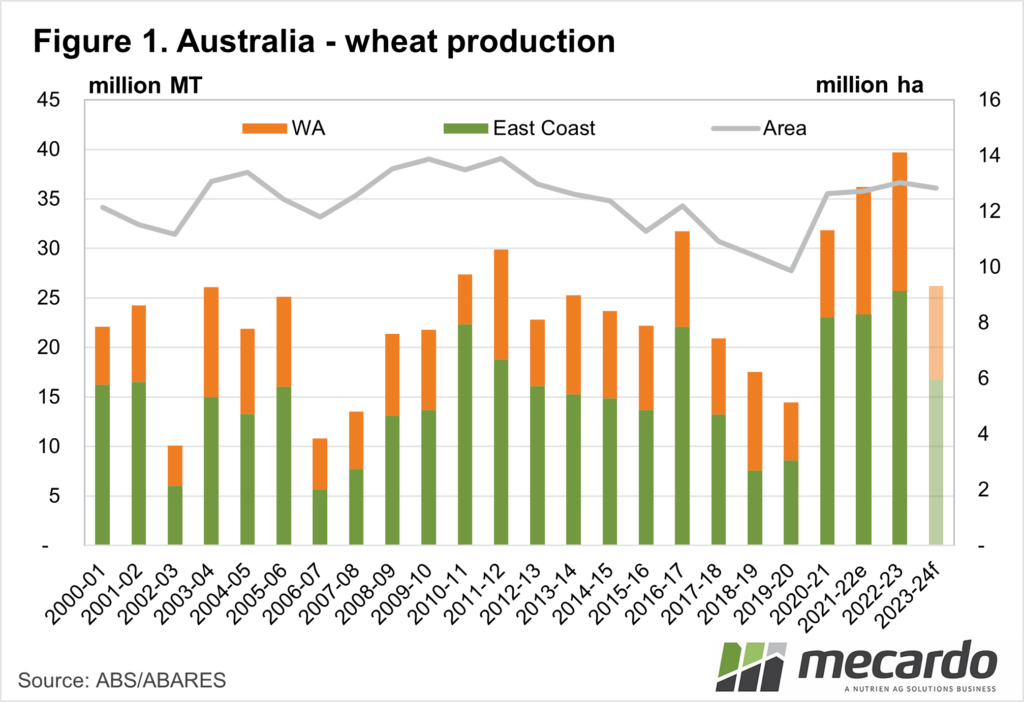

Starting with wheat, we can see from Figure 1 that ABARES are not seeing much of a shift in plantings, despite some less-than-ideal conditions during the autumn. The total area planted to wheat is forecast to fall 1.6% in 2023-24, with the fall largely due to a shift towards barley plantings.

Wheat yields are forecast to fall heavily across all states. The national average wheat yield is forecast at 2.04t/ha, down from 3.04t last year. Both east and west coasts are expected to be down, with forecast yields 33% lower on the east coast, and 31% in the west. Tasmania, which produces 0.66% of the national crop, is the only state which is expected to have stronger yields.

As a result of the small decrease in plantings, and large decreases in yields, we can see in Figure 1 that national production is forecast to fall a massive 34%. On the east coast, yields are forecast to be down 35%, and 32% in the west. Wheat production is still expected to be well above the average that was seen before the 2020-21 levels.

After the dramatic fall in barley plantings in 2022-23 thanks to the Chinese tariff introduction, producers are expected to make a small shift back to the less popular cereal. Figure 2 shows barley plantings forecast to increase by 4% on last year, but they will still be 22% below the peaks of 2020-21.

Similar to wheat, barley yields are forecast to fall heavily, leading to a production decrease of 30% despite the increase in plantings. Again, both the east and west coasts are expected to experience a decline.

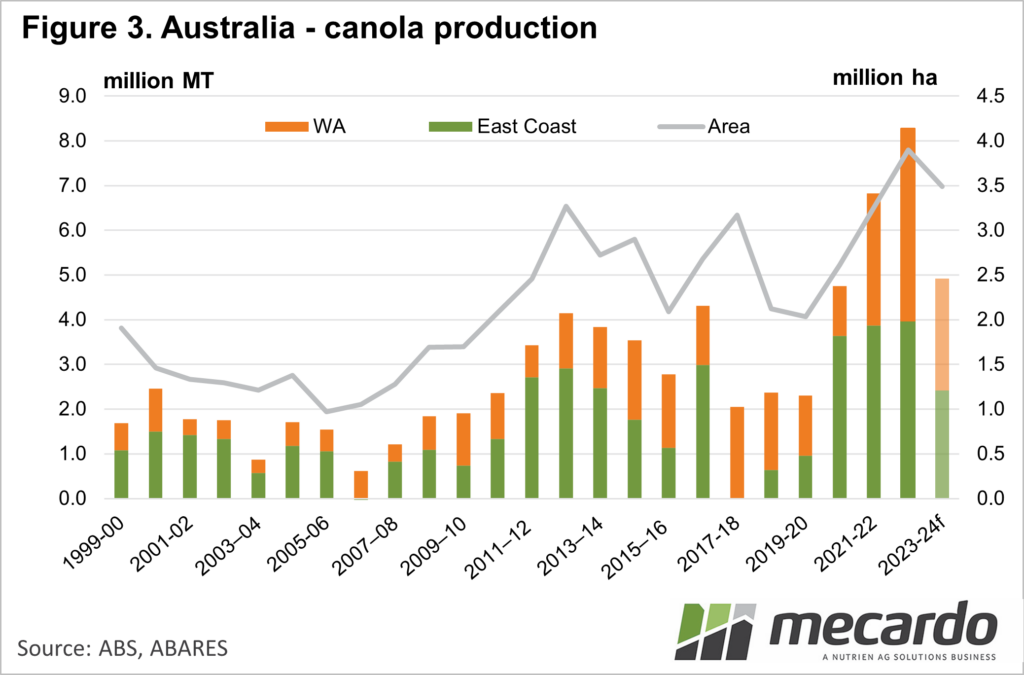

Canola plantings are forecast to decline from the record highs seen in 2022-23. A fall of 11% nationally is mostly due to a 14% decline in WA. The importance of canola in rotations can’t be underestimated however with the WA plantings still expected to be the second-highest on record.

Similar to the other crops, the forecasted decline in canola production will be impacted most by the projected yield figures. A yield decrease from 2.12t/ha to 1.41t/ha, will see canola production at a 3-year low, but still the third highest on record.

What does it mean?

When commodities are traded in global markets, lower production doesn’t always equate to higher prices. Locally, lower production does generally result in higher basis, or stronger local prices relative to international values. There is no rush to lock in basis, with plenty of water left to pass under the bridge or fall out of the sky, before forecast production is realised.

Have any questions or comments?

Key Points

- The ABARES crop report is forecasting significant declines in production for the coming year.

- Barley will see a small increase in plantings, Wheat and Canola plantings will be down.

- Weaker winter crop production should see stronger basis for the coming harvest.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: ABARES, Mecardo