Canola crop and production will be impacted by a dry spring, but due to geographical spreads and differences in relative demand, it doesn’t get the price support we see for cereals during dry times. Despite this, prices have been on the improve, not in an absolute sense, but in relative terms.

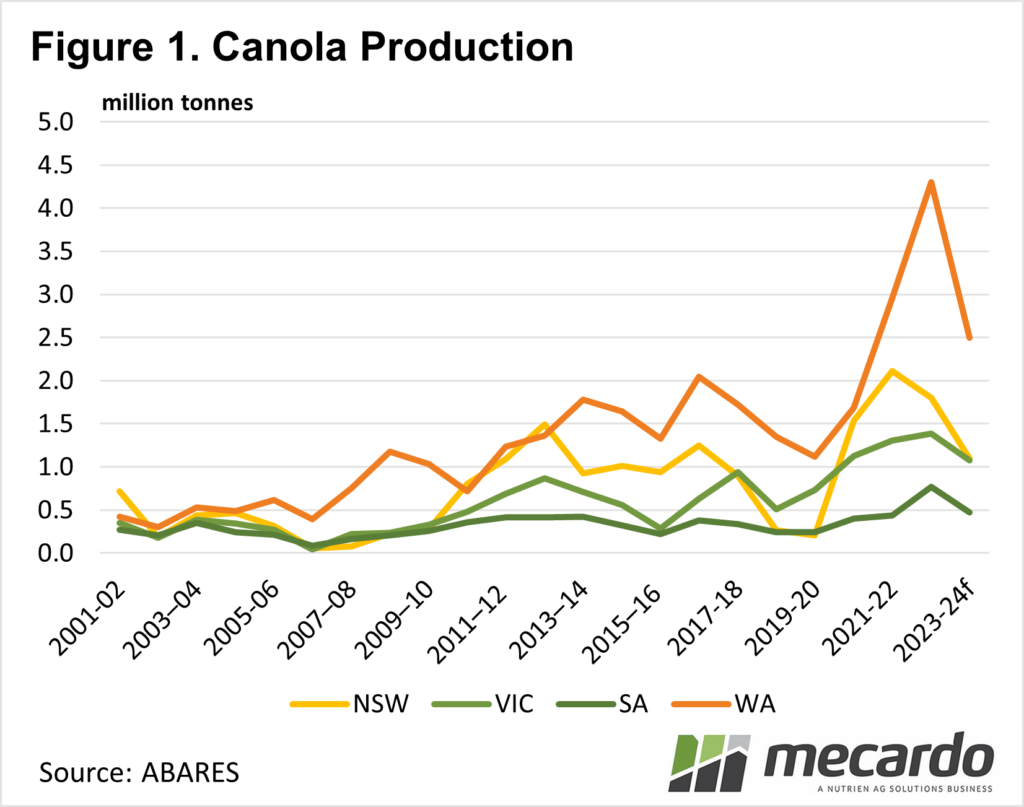

There isn’t much canola grown in northern New South Wales, which is the driest sector of the cropping regions at the moment. Figure 1 shows state canola production over the last 20 years, and while NSW is the largest producer on the East Coast, much of it comes from central and southern areas.

The Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) forecast has canola production in NSW dropping 39% this year, which probably isn’t enough considering the season hasn’t really improved since the report was released.

You can see in Figure 1 that Victoria and South Australia, both of which are having better seasons (than NSW), are expected to produce just over 1.5 million tonnes of canola this year. During the drought years of 2018 and 2019, total East Coast canola production was 1-1.1 MMT, so it looks like even with a poor finish, canola should surpass that this harvest.

Despite what should be reasonable supply this year, selling has been slow. The combination of weaker prices than the last two years and the drier season has canola producers reluctant to sell, and this is pushing the basis higher.

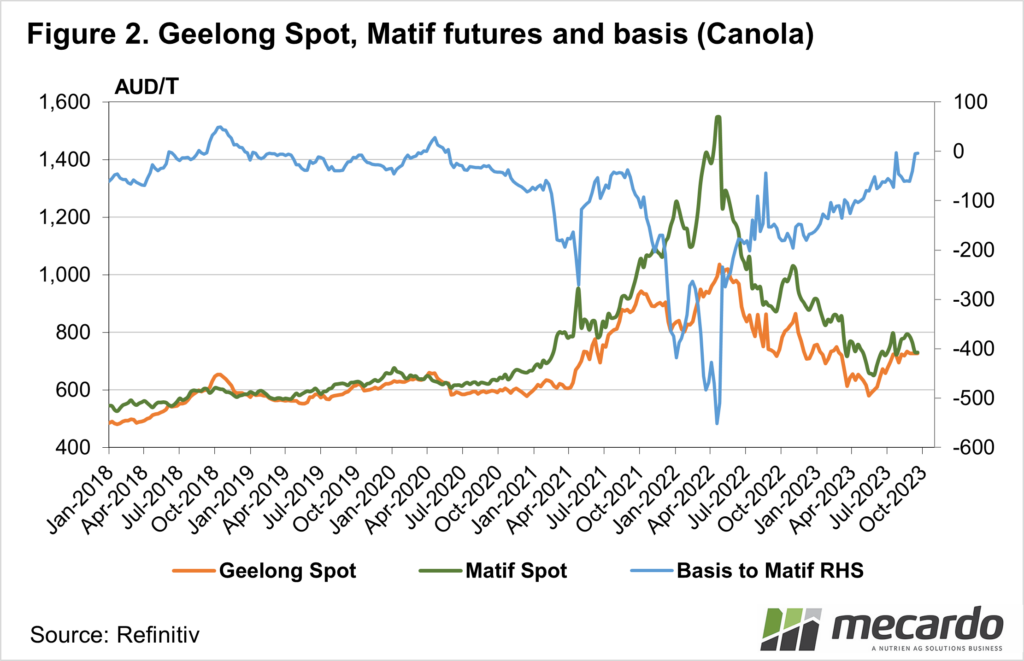

Since the last harvest, Geelong canola basis to MATIF Rapeseed has increased from -$160/t to parity. Much of the improvement in basis is on the back of weakening international prices, although local prices have rallied around 20% from May lows.

The question now is can we expect further improvement in basis with a worsening season? Figure 2 shows that the peak of canola basis in 2018 and 2019 was $40/t in October 2018, otherwise, it ranged between -$40 and parity. This was during a period of extremely low production.

What does it mean?

Canola basis has done much of its work already in response to a drier year. There is a good chance that harvest pressure could see prices fall in late October through to December. Canola is first harvested, priced okay, and as such will be the first thing sold to aid cash flow. This will have a negative impact on basis.

For those confident in producing some canola, it might be worth locking prices in on a few loads once the frost risk is passed. At least then it saves the worry about selling in a falling harvest pressure market.

Have any questions or comments?

Key Points

- Forecasts for canola production are still well ahead of drought years despite the drier outlook.

- Local canola prices have improved relative to international values, with little more upside.

- Selling some canola pre-harvest will avoid likely harvest pressure come November.

Click on figure to expand

Click on figure to expand

Data sources: ABARES, Refinitiv, Mecardo