Last week we covered the headline numbers from the United States Department of Agriculture (USDA) World Agricultural Supply and Demand Estimates (WASDE) report. This week we delve a little deeper looking for price direction for barley and canola.

The data behind the WASDE report is a bit like a rabbit hole. There are forecast for all sorts of commodities, and a lot of time can be wasted downloading datasets. If that’s what you’re into. A couple of the most pertinent for Australian croppers are barley and canola, some of our largest crops.

Barley is largely part of the global coarse grain complex which is largely used for stock feed. Barley is a small part of the complex, with production in the coming year expected to hit 147mmt. By comparison, corn production is forecast at 1219mmt, over eight times higher than barley.

The USDA data pegs barley feed consumption at 69% of production. This assumes 31% of corn production is used for malting, and the malting side of barley demand can move the market independently of global feed grains.

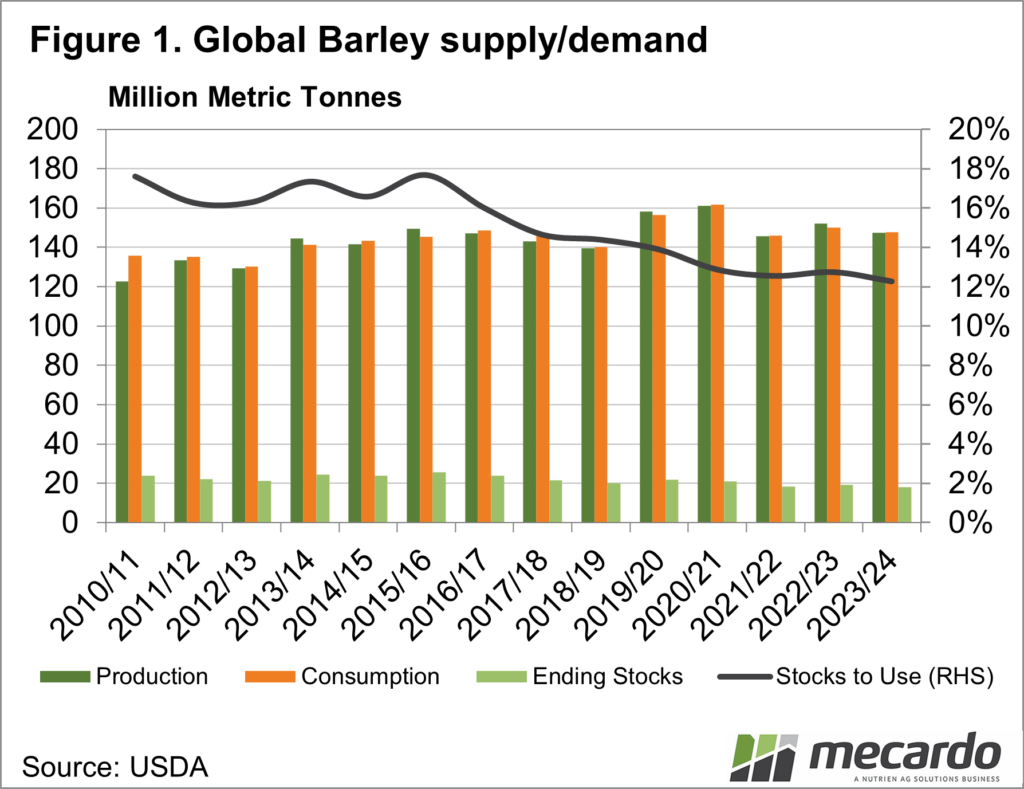

Figure 1 shows that barley production outstripped demand in the year just gone, leading to a small increase in stocks. In 2023/24 the USDA is forecasting a 9.6% decrease in barley production, with much of that decrease coming from a 30% fall in Australia.

Barley consumption is also forecast to fall, with a slight reduction in stocks. We can see in Figure 1 that the stock-to-use ratio is expected to hit new long-term lows of 12%, but in reality, it’s not much lower than in recent years.

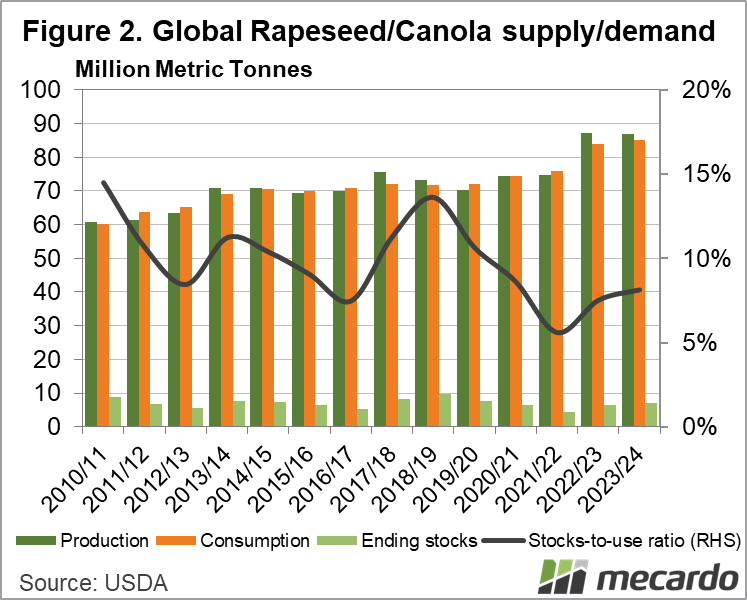

Rapeseed and canola follow global oilseed markets, which are dominated by soybeans. Canola production forecasts of 87mmt are just 13% of global oilseeds production.

Figure 2 shows canola production jumped higher last year, as prices skyrocketed with tight global oilseed supplies and the war in Ukraine. Canola production is expected to remain steady, while consumption is up. We do, however, still see stock recover further from the lows of 2021-22, with the stock-to-use ratio back to 8%.

What does it mean?

The broad takeout from the WASDE forecasts is that barley should find price support, relative to global feed markets, with stocks remaining relatively tight. There are factors like the China trade which could move barley higher, without a change in supply.

If the USDA forecasts come to fruition canola prices are likely to remain under pressure. Soybean prices will continue to underpin canola, but the recent premiums are likely to continue to erode if the northern hemisphere seasons progress as expected.

Have any questions or comments?

Key Points

- The USDA WASDE is forecasting opposite fortunes for barley and canola stocks.

- Barley supplies are expected to remain relatively tight, while canola is forecast to improve.

- Barley prices should continue to find support, and canola will come under pressure.

Click on figure to expand

Click on figure to expand

Data sources: USDA, Mecardo