The young cattle market hit yet another record high this week as the herd rebuild combines with tight international supply to push prices in the stratosphere. There are plenty wondering when the peak will come, and how far prices might fall. The good news is the downside keeps going up.

When we say the downside is going up, we mean the base of the market is rising, and this is helping push the new extreme highs. While local restocker demand pushes values to extreme highs, it is the export market which provides the base. The stronger the export demand, the higher the base in the market. Local cattle supply and demand moves cattle prices around this base level.

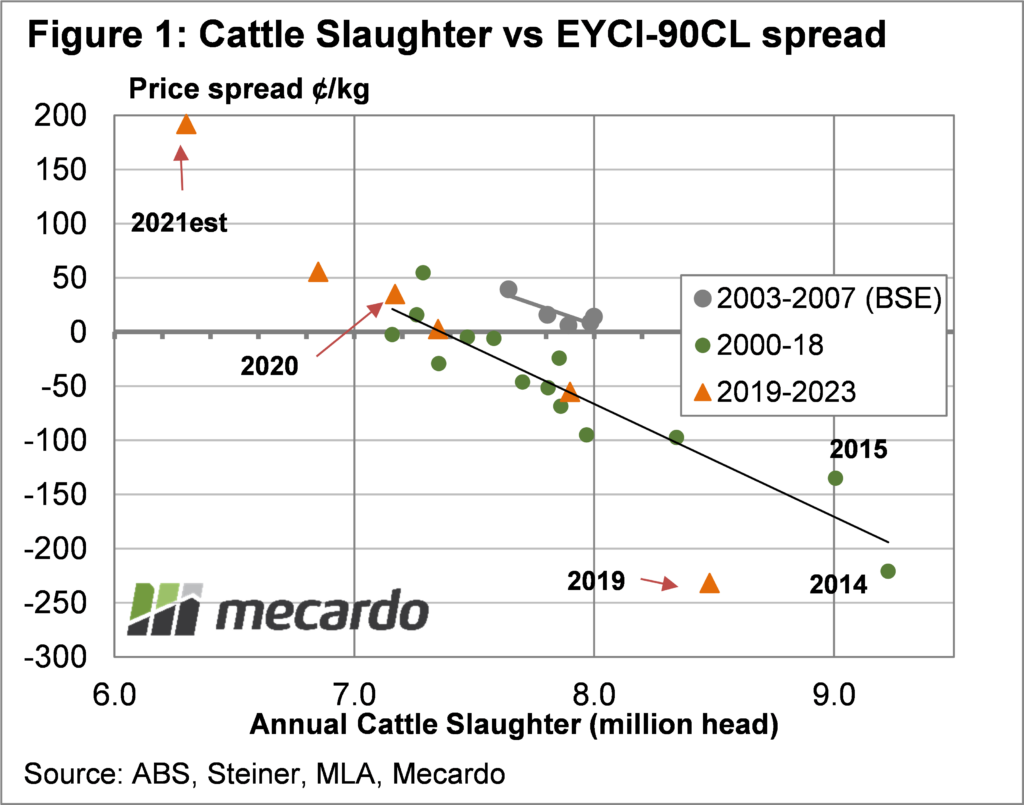

We always knew that the Eastern Young Cattle Indicator had a relationship with the 90CL Frozen Cow US Export beef price indicator, but it was when we ran it against cattle slaughter that we found an even stronger relationship.

Figure 1 shows that slaughter gives a remarkably good indication of where the EYCI will finish in relation to the 90CL Indicator. Intuitively it makes sense. The lower supply and therefore slaughter, the higher the EYCI is relative to the 90CL.

The opposite is also true. In times of drought and/or heavy cattle supply, the EYCI is weaker relative to the 90CL. Just 2 years ago, in 2019, a slaughter bottleneck, extreme drought and very high export prices, pushed the discount off the curve to the downside.

Looking at this year, restocker demand has pushed prices off the curve to the upside. Figure 1 shows the MLA slaughter forecast of 6.3 million head has been met thus far with an EYCI premium of 192ȼ. This is slightly above the curve prediction of 150ȼ, but if slaughter is under 6 million the curve is pretty close.

Looking forward cattle slaughter for 2022 is expected to increase to 6.85 million head, giving a premium of 50ȼ. The 7.35 million head expected to be slaughtered in 2023 will have the EYCI about even with the 90CL.

What does it mean?

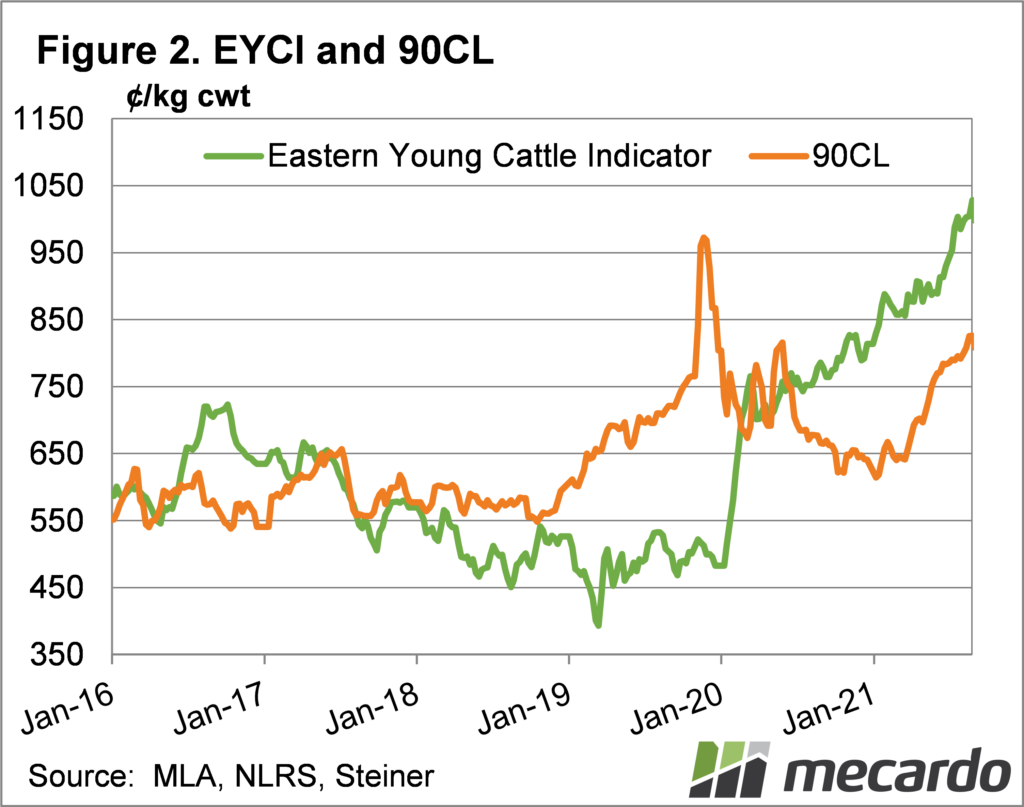

Figure 2 shows the 90CL and EYCI, and both have been rising strongly. It looks like the 90CL price rise might be more sustainable than 2019, and this is supported by tight international beef supplies. The 90CL could fall to 750ȼ, and increasing slaughter in 2022 will see the EYCI premium decrease, but it would still leave it at 800ȼ. Still a very profitable level for cow/calf producers.

Have any questions or comments?

Key Points

- The EYCI has hit another record driven by local supply and demand.

- Export beef markets provide a base for cattle prices, and they have also been rising.

- Increased slaughter, and a fall in export prices could be sustained with the EYCI still above 800ȼ.

Click to expand

Click to expand

Data sources: USDA, Steiner, MLA.