This time last year the wool market was tanking, but it wasn’t quite early enough to see a switch out of Merino joinings and into meat breeds. This year the wool market has lifted early in the year, but has it been enough to keep Merino lambs coming in the winter and spring?

A few weeks back we took a look at AWI and MLA’s wool and sheepmeat survey, and were surprised to see the proportion of Merino Ewes joined back to Merino Rams in for spring lambing. Merino Ewes joined to Merino Rams made up 60% of all ewes joined for spring lambs, up from 56% in 2019, and the low of 48% seen in 2016.

The strong wool prices of 2019 and early 2020 saw Merino’s making somewhat of a comeback, at least in proportional terms. The season didn’t allow increases in total ewe joinings.

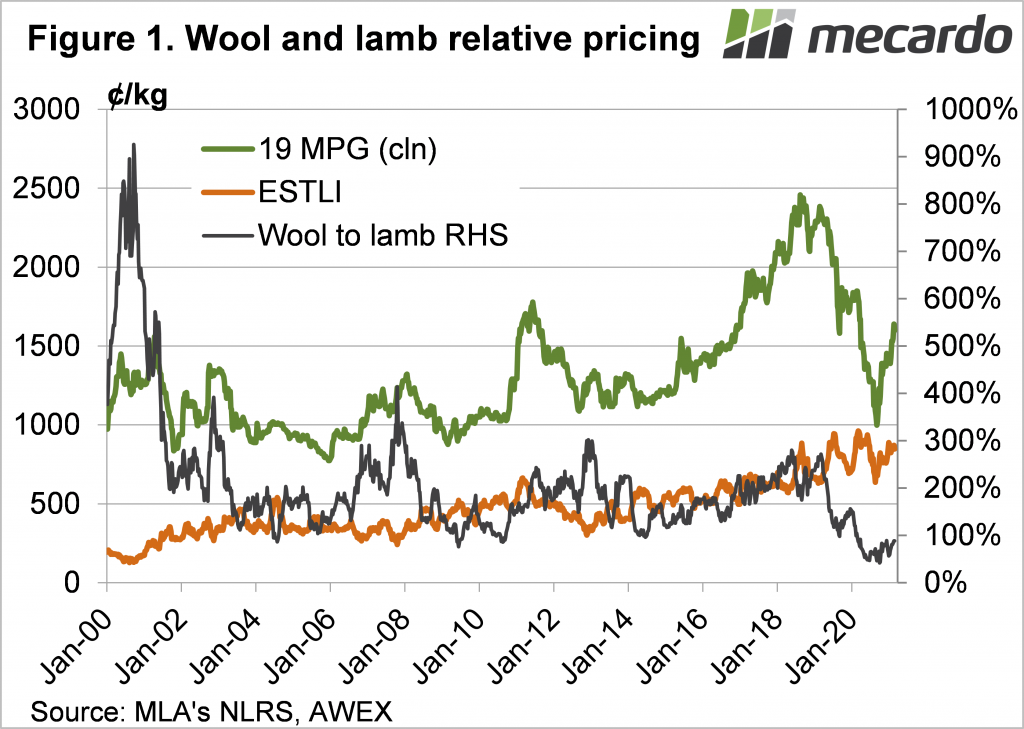

Following the tanking wool prices, and relatively strong lamb prices of the post-Covid markets there was plenty of concern for the future of Merinos. Back in April last year we looked at the relative pricing of 19 micron wool and trade lambs, with the relative price of wool at an all-time low.

Figure 1 shows wool prices have rallied since the lows of last spring, with a 75% rally nothing to be sneezed at. Lamb prices have also strengthened however, gaining 30% from lows, and now sitting 100¢ behind the all-time highs of this time last year.

We can also see in figure 1 that the 19 micron wool premium to the Eastern States Trade Lamb Indicator (ESTLI) hasn’t actually improved that much. During the first quarter of 2020 the 19 MPG averaged a 131% premium to the ESTLI. Seemingly enough to encourage merino breeders.

From May to October 2020 the 19 MPG averaged just a 57% premium to the ESTLI. During the first two months of 2021, the 19 MPG averaged 78%, still lower than any time prior to March last year.

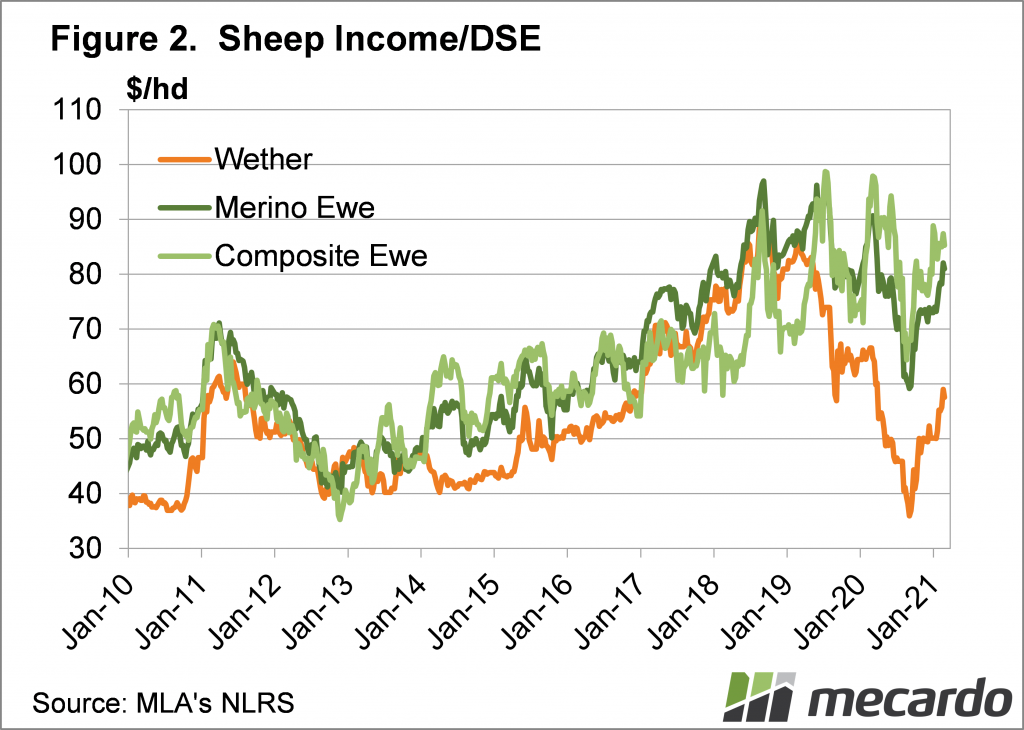

Figure 2 shows a basic model for income per dry sheep equivalent for composite ewes, Merino ewes and Merino wethers. Merino wethers remain way behind ewes, which, when combined with good mutton prices makes them good selling. Interestingly, composite ewes are only $5 in front of Merinos, but history tells us Merino income per DSE needs to be at a premium to see Merino flocks expand.

What does it mean?

With joinings for winter and spring lambs underway or about to start, despite the rise, wool prices might not have done enough to deter a swing back to joining Merinos to terminal or maternal sires. Down the track, this means there will be more lambs destined for processors later in the year, or early in 2022, and slower growth in the supply of Merino replacement ewes, and Merino wool.

This gives long term support for wool, and continued support for breeding ewes, but might depress lamb values.

Have any questions or comments?

Key Points

- Wool prices have rallied strongly from lows, but lamb values are also strong.

- The 19 MPG premium is stronger than last winter, but remains historically low.

- There doesn’t appear to be much impetus for merino flock expansion this year.

Click to expand

Click to expand

Data sources: MLA, AWI, Mecardo