Grain growers who follow a strategy of making forward and futures sales in our autumn, when prices are usually at their best, are a likely a little out of the money on wheat, and way out of the money on canola by now. If there isn’t enough confidence to sell more for 21-22, it might be time to look at what’s on offer for 22-23.

Grain growers who follow a strategy of making forward and futures sales in our autumn, when prices are usually at their best, are a likely a little out of the money on wheat, and way out of the money on canola by now. If there isn’t enough confidence to sell more for 21-22, it might be time to look at what’s on offer for 22-23.

When supply issues are causing grain and oilseed prices to move to extreme highs, the market will often go into what’s called backwardation. Backwardation is when future prices are lower than current prices, and it’s not normal in futures markets.

Usually future grain values are set at the current prices plus the cost of carry. At the moment the market is expecting high prices to be the cure for high prices, encouraging ramping up of production, thereby seeing prices ease for the next harvest.

Growers always have a hard time locking in prices which are at a discount to the spot, and sometimes a bit more perspective is required.

The wheat forward curve is in backwardation, but it’s not a huge discount out to next harvest. Figure 1 shows the Chicago SRW curve in Aussie dollar terms. Dec-21 SRW is in the mid 370s, and just $5-10 lower for the 22-23 harvest.

If we plug the Dec-21 SRW price of 720¢/bu in US terms into a percentile table, it’s 84% over the last 10 years. Prices could go higher, but history tells us they are more likely to go lower.

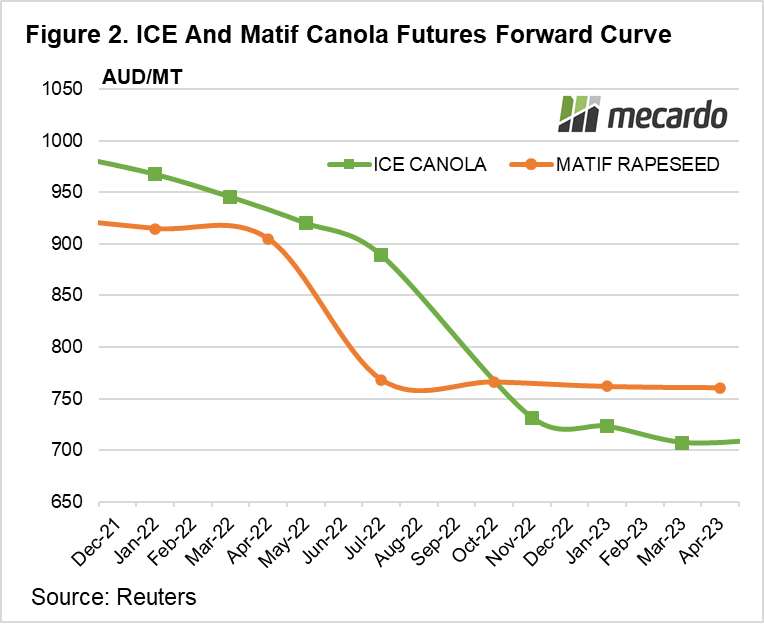

For canola the forward curves are at a larger discount, but prices are historically better. Figure 2 shows forwards for the coming harvest are well above $900/t for ICE and Matif futures. When new crop northern hemisphere supplies come online next July and September, prices fall, but are still at $775/t on Matif and $710/t on ICE.

Despite a discount of nearly $200 per tonne from old crop to new crop, canola prices for 2022-23 are still above the 97th percentile, with prices only having been higher in this latest extreme period.

What does it mean?

Many growers are understandably reluctant to lock in any further grain sales for the coming harvest, but the new crop might be a more palatable sale. We have seen in the past that prices will come back, with high prices encouraging increased plantings.

There is the risk of further production issues, and prices moving higher again, but that only means another year of selling most grain at extreme prices, and wearing a loss on the hedged percentage. Making a start on 2022-23 sales with prices at very profitable levels should add some comfort if values start to decline.

Have any questions or comments?

Key Points

- Grain and canola prices are very strong, and forward markets are at a discount.

- Despite the discount in forward markets, prices can be locked in at very high levels.

- If growers are comfortable with sales for this year, focus can shift to 22-23.

Click to expand

Click to expand

Data sources: Refinitiv, Mecardo