Amongst all the commentary about supply, demand, quality schemes, power shortages, fashion and so on it is the price received when selling wool which is the key to that wool being produced. This article takes a look at merino prices in the current market.

Wool covers a wide range of qualities. This article will focus on merino wool ranging from 14 to 24 micron, which is the range of fibre diameters sold last week at auction in Australia. The combing fleece data series used combined a wide range of length (above 50 mm greasy length), with vegetable fault less than 2%, no subjective faults and a staple strength 30 N/ktx or greater. The carding fleece series is made up of merino locks and crutchings with no serious stain and a vegetable matter range between 1 and 5%.

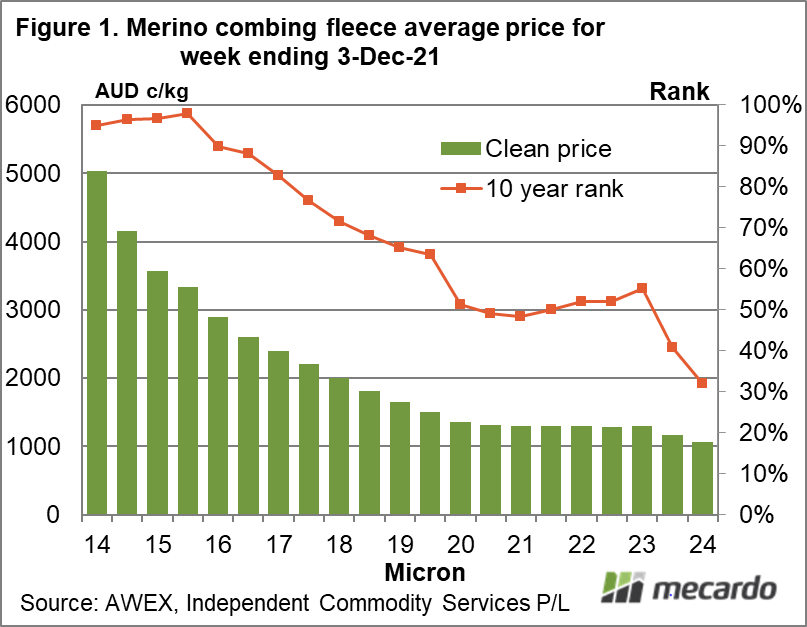

Figure 1 shows the average combing fleece prices by half micron for last week (left hand axis) along with the 10 year percentile rank for these prices (developed with weekly data). The price curve remains quite a steep one for 19.5 micron and finer wool, with the percentile rank picking up from around the 50th percentile for 21 micron and rising into the high 90s for 15.5 micron and finer. In summary it remains a good market for 19.5 micron and finer wool in terms of price.

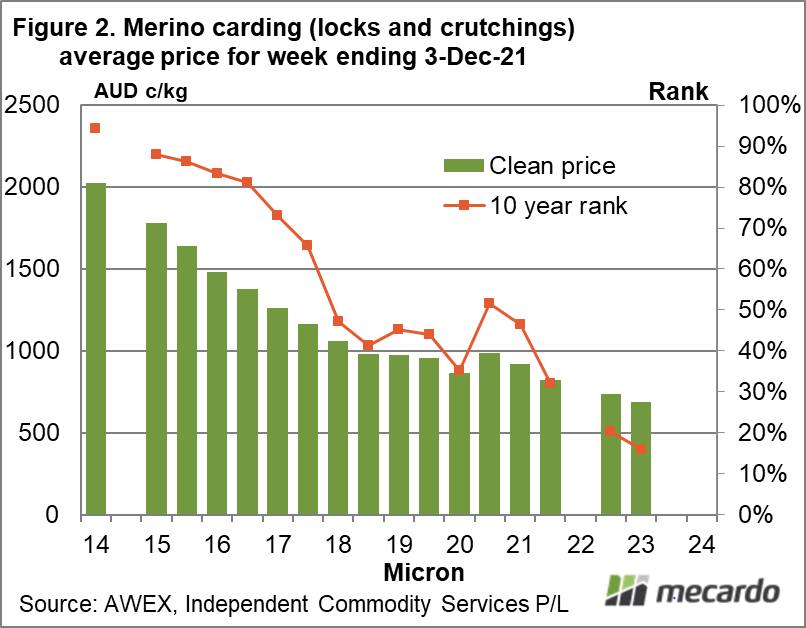

In Figure 2 the exercise is repeated for the merino carding series. This last micron cycle (beginning in 2020) has been unusual in that sizeable micron premiums have been operating in the carding part of the market as well as the larger combing section. This is generally not the case, hence the single official carding (Merino Carding) indicator produced by AWEX, which is skewed to the broader side of the merino carding micron distribution. The price curve starts to rise from around 18.5 micron, peaking last week at 2000 cents for 14 micron. The 10 year percentile level follows a similar trajectory, rising from around 41% for 18.5 micron to finish at 94% for 14 micron.

Prices on the broad edge of the merino micron distribution are complicated by a lack of volume and overlap with the finer crossbred micron categories. The drop in rankings for both the carding and combing merino series around 23-24 microns reflects the “gravitational” effect of the extremely low crossbred market.

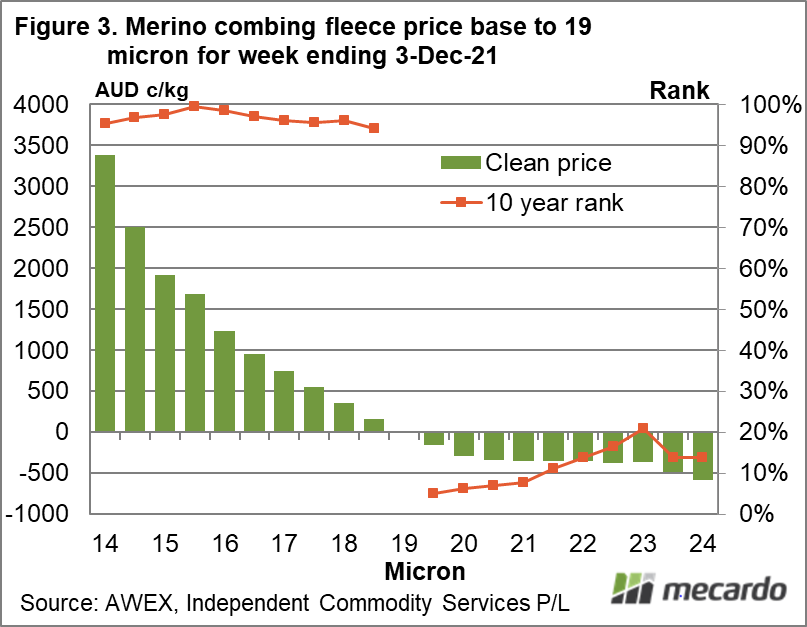

Finally, what about the relative prices of the different micron categories? Figure 3 shows the premiums and discounts for the combing fleece series compared to a base 19.0 micron price. The 10 year [percentile rankings for these premiums and discounts are shown. From the perspective of micron premiums and discounts the merino market remains at extreme levels.

What does it mean?

While merino prices are sedate compared to the heady levels of 2017-2018, the market is high by the standards of the past decade, with fine micron prices high for both combing and carding wool. A depressed crossbred market is pulling the very broad merino prices lower, with the “bread and butter” 20-22 micron categories are trading around decade median levels.

Have any questions or comments?

Key Points

- While the broader merino prices remain around decade median levels, the finer micron categories continue to trade at high levels, by historical standards.

- Sub 18.0 micron merino cardings also continue to trade at high levels by the standards of the past decade.

- In terms of micron premiums and discounts, the merino market remains at extreme levels.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: AWEX, ICS, Mecardo