Amid the lower grain and oilseed prices this harvest, at least some inputs have also come off their extreme highs thanks to more stability in supply. When urea was expensive, we looked at the cost and benefit of applying it to crops. Now that it’s cheaper it’s worth checking on the tradeoff with the outlook for canola in 2024/25.

The

last time we ran this analysis, supply chains were in a state of disruption.

Covid-19 and the war in Ukraine each had

varying impacts on the supply of inputs, trade of commodities, and costs, and

raised concerns of supply chain resilience. In 2022 Australia’s normal pattern

of fertiliser imports was turned on its head, particularly phosphates. This year a decrease in urea volumes out of Southeast Asia has also caused

problems for supply chains. In the first three quarters of 2023 urea imports

from Malaysia as a proportion of total Australian imports dropped from 20% in

Q1-3 2022 to 11% in Q1-3 2023. Similarly, Indonesia’s share of supply dropped

from 14% to 5% over the same period while the share of the UAE shifted from 21%

to 30%, and Qatar up from 11% to 42%

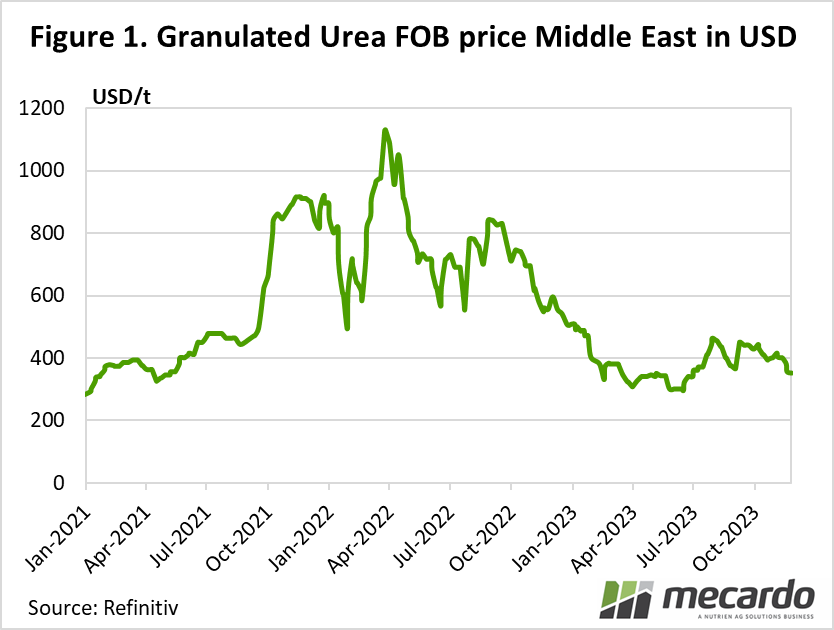

Over the past year, urea

prices have fallen rapidly. The price shown in Figure 1 is the Middle East

export price, so not indicative of values here, but it shows the international

trend in prices. Urea has more than

halved from the peak but is still around 85% stronger than pre-war values.

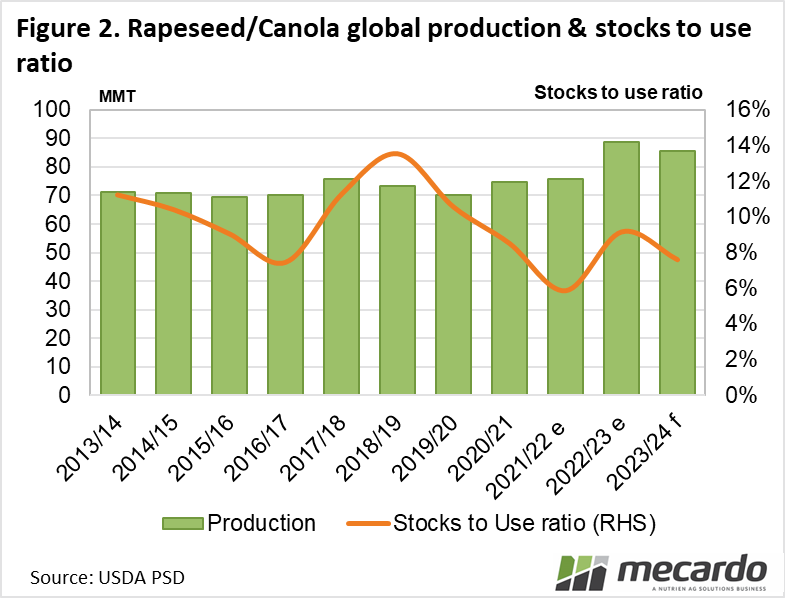

While we don’t know

what the canola price will be come harvest 2024/25, the supply and demand

picture is starting to shape up and can provide some clues. Despite a bumper global canola crop in 2022/23, and 2023/24 forecasts

by the USDA tipping production to be the second highest on record, the supply

and demand balance for canola remains tight. In fact, the global canola stocks-to-use

ratio for 2023/24 is expected at 8%, not a record low but certainly tight (Figure

2).

The US, with its growing appetite for rapeseed

oil to ‘fuel’ its Renewable Fuel Standard program, is a key source of

additional demand. US rapeseed/canola oil imports for industrial purposes in

2023/24 are already estimated to reach a record 3 million tonnes. Casting the

net out to 2024/25, growth in renewable diesel demand in North America is

expected to drive an increase in demand for rapeseed/canola.

With this in mind, the trade is currently

expecting the supply and demand balance for canola to remain tight into 2024/25.

The MATIF forward curve is currently pricing Nov ‘24 canola at a 3% premium to the

nearest Feb ’24 price. If we apply that premium to Australian canola values

(not taking basis changes into account), it would put the 2024/25 harvest price

at $720 in Kwinana which we can use as a rough guide in our trade-off

calculation.

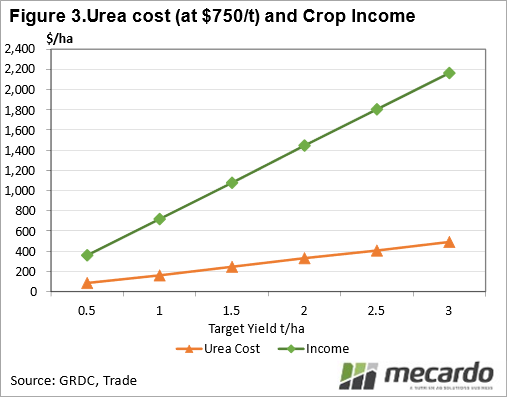

Figure 3 shows the

cost of nitrogen used per hectare, versus the value of the canola crop per

hectare at different target yields. The chart assumes urea costs $750/t not

including spreading, while the canola price is estimated at $720/t. There is

also the assumption that all the nitrogen required (40kg/t produced) is spread as

urea, which obviously isn’t the case. Nitrogen already present in the soil will

be used, as will that in sowing fertiliser. Nitrogen response rates have been sourced

from the GRDC.

What does it mean?

There is plenty to be gained for croppers in using urea on good N-responsive soils. Looking ahead to next season, there might be some value in planning fertiliser requirements sooner rather than later. While we don’t want to expect the worst, we’ve seen the consequence of disruptions to global supply chains on the supply of inputs over the last three years. ‘Just in time’ supply isn’t without risk in the current environment of global trade.

Have any questions or comments?

Key Points

- Urea prices have more than halved over the last year from peak to trough.

- Using urea to boost canola yields will have a strong positive payoff.

- Planning 2024/25 requirements early will help to mitigate the risk of ‘just in time’ supply.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: Refinitiv, GRDC, ABS, Mecardo