Good seasonal conditions across eastern Australia during 2020 have provided relief to the flock size, by allowing farmers to hold stock back from sale in order to rebuild sheep numbers. This article takes a look at how this process is going.

Mecardo last looked at the sheep offtake in Australia in June 2020, noting that the offtake had turned positive for the flock size (in other words the number of adult sheep sold off-farm had fallen sufficiently) and that the outlook depended on rainfall in the upcoming spring which turned out to be good. Rainfall, a proxy for seasonal conditions, is a key driver of the sheep offtake and once again in 2021 it will determine what happens as to the current flock expansion.

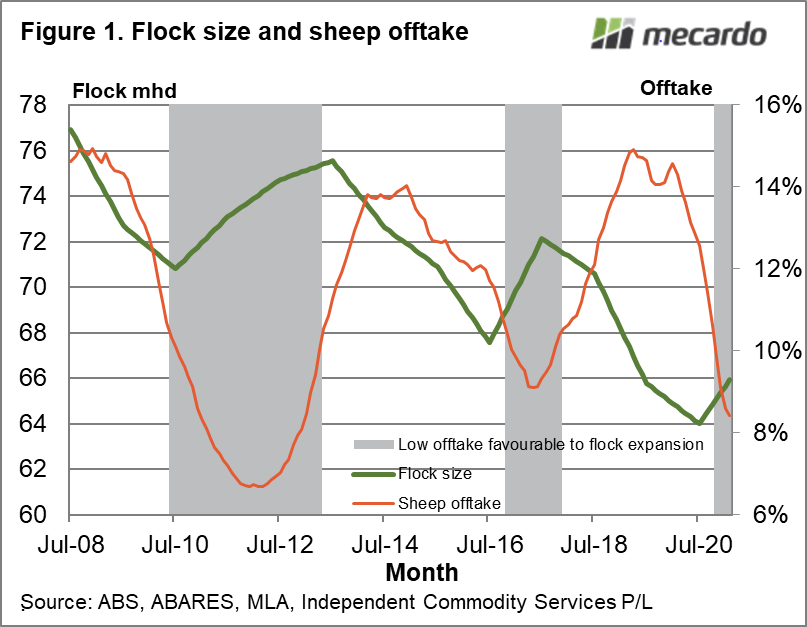

Figure 1 begins in mid-2008 and runs to last month. It shows the estimated flock size, with the series interpolated between mid-calendar year estimates. Also, Fig 1 shows the rolling 12-month sum of adult sheep sold off-farm to abattoirs, expressed as a percentage of the flock size (the sheep offtake), with shaded areas representing where the sheep offtake falls below 10.5%, the periods of flock expansion. The flock offtake, which also takes into account live sheep exports out of eastern Australia, had fallen to 8.4% in February which is some 2% below the sustainable level. From an adult sheep perspective, this means the flock could expand by mid-2021 by 2%, given normal weaning and death rates (something of a fudge factor in such estimates).

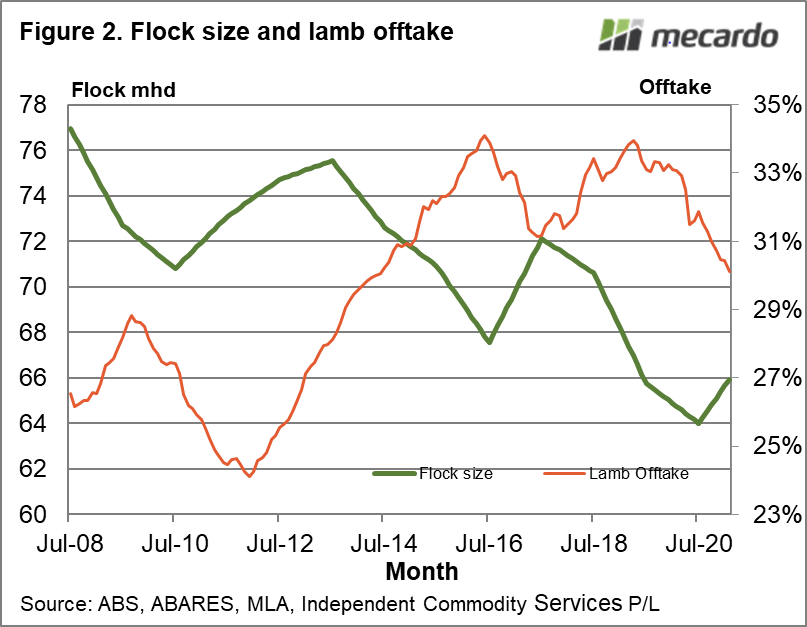

In the past decade the proportion of lambs turned off from the Australian flock has changed structurally. Figure 2 compares the flock size and the lamb offtake from mid-2008. A decade ago the lamb offtake ranged between 25% and 29%, whereas now the normal range looks to be 30% to 34%. A look at Figure 2 shows a relationship between the lamb offtake and the flock size, with the flock increasing when the lamb offtake falls.

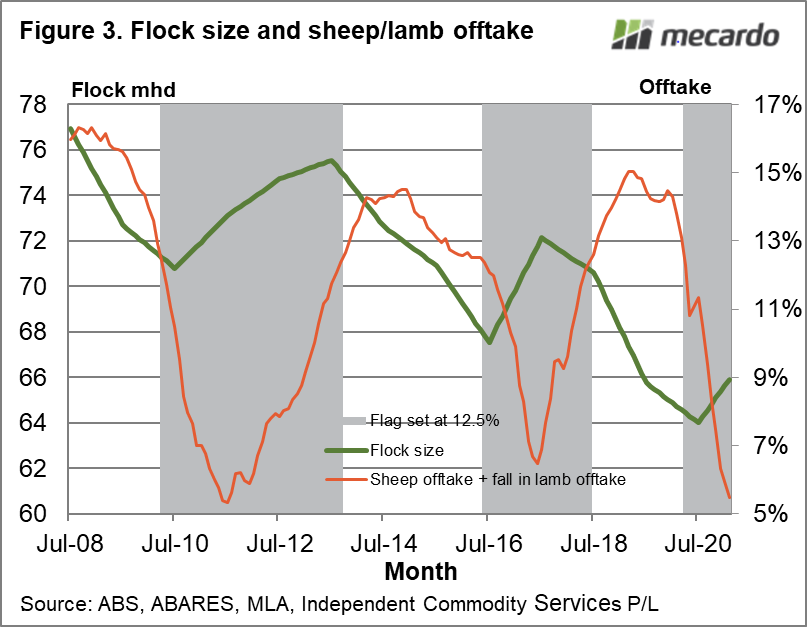

Figure 3 adds any falls in the lamb offtake to the sheep offtake, seeking to better describe the periods when a flock expansion is likely to happen. By doing this, the low points of the combined sheep/lamb offtake line up for the current period, 2016 and 2011, which are the recent wet seasons. The combined offtake tends to bottom out around 5-6%. It is currently 5.5% which is positive for the flock and some 7% below what looks to be the sustainable level which implies the flock is building at a rate closer to 7% (give or take a percentage).

This simple model supports the latest MLA projection for an expansion of the flock by 5.2% by mid-2021, and it looks on track to meet the projected 6.2% expansion next season given reasonable spring rainfall.

The model presented here also allows sheep and lamb slaughter projections to be tested. The MLA lamb turn-off is projected to be around 30.5% for the next two seasons, which is quite low given the flock performance over the past 6-7 years. The projected sheep turn-off looks high given the flock is still projected to be expanding. Next season the sheep turn off is projected to be 10.2% and the season after 11% (which is contractionary). Given reasonable season conditions, the sheep turn-off has to remain well below 10.5% for the flock to expand.

What does it mean?

From a price perspective, supply looks set to remain supportive of sheep meat prices in the coming season, in the absence of droughts (a failed spring). From a wool perspective, supply should increase during the next few seasons given median rainfall or better, for which categories, is less certain.

Have any questions or comments?

Key Points

- The combined sheep/lamb turnoff is currently at expansionary levels, on par with the levels seen following 2016 and before that, 2010 and 2011.

- As usual projections for the new season (2021-22) will depend largely on spring rainfall in south-eastern Australia.

- Flock projections by the MLA look realistic, with overly optimistic sheep slaughter numbers (assuming the flock continues to expand).

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: ABS, ABARES, MLA, Independent Commodity Services, Mecardo.