Making long term projections is always fraught with danger, as there is so much which can change over a season, let along ten years. Regardless, the United States Department of Agriculture (USDA) like to throw a few darts, and they have made some herd and production estimates for the US which are relatively bullish for prices.

Part of the reason for such strong cattle prices in Australia at the moment is the strong export beef price, which in turn is driven by tight global cattle supplies. The US is one of the world’s biggest beef producers, and consumers, so it makes sense that the world looks to the US cattle herd for an idea of where prices might be headed.

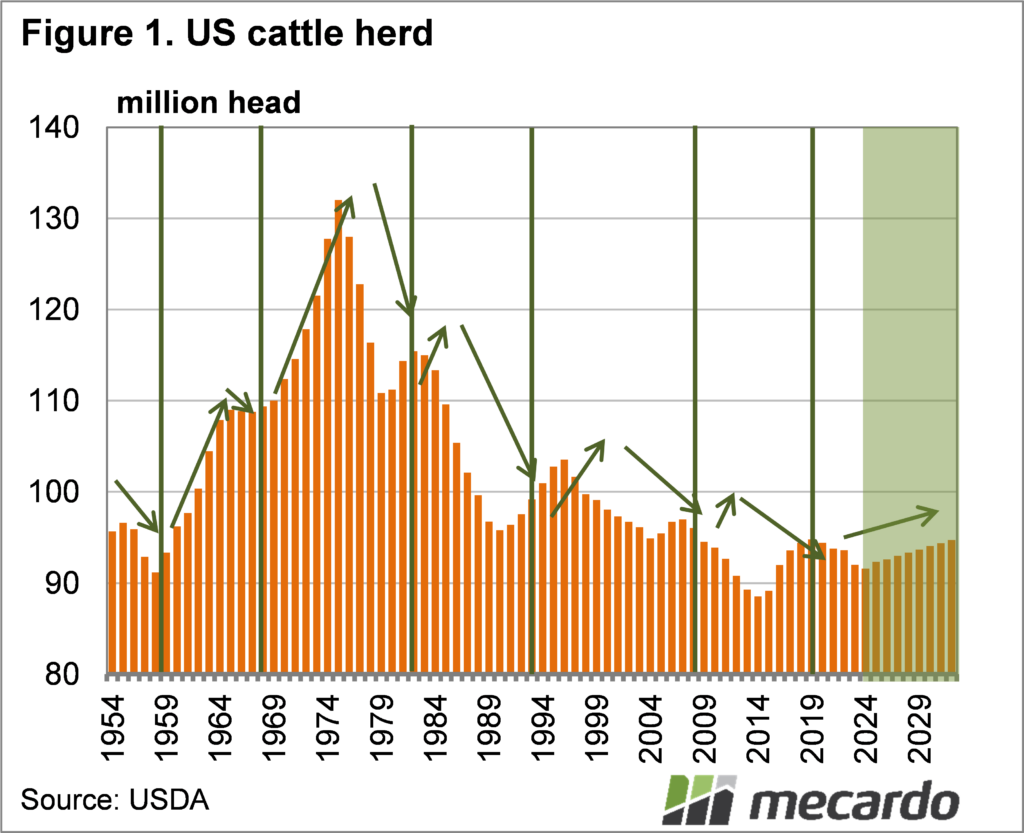

After five years of growth the US herd has been declining for the past two. Figure 1 shows that the US cattle herd is a long way from it’s glory days of over 130 million head back in the 70’s. The current US herd, which is pegged at 93.5 million head is just 3% lower than the 2007 peak, but it’s worth nothing that 3% equates to over 3 million head. This is more than 10% of the Australian herd, so even small changes in the US herd can have large impacts on global prices.

Every year the USDA release their ‘baseline’ projections. The baseline projections show what the USDA expect to happen with production of a range commodities based on some key assumptions on economic growth.

Growth in the US herd would be expected given strong global prices, but these aren’t really being translated into US cattle prices due to processor bottlenecks. Nevertheless, the USDA are expecting these issues to dissipate and US and seasons cattle prices to rise 7% next year, and 10% in 2023, and more incrementally after that.

The impact on the herd is expected to be negative for a start. Figure 1 shows the USDA expect the US herd to bottom out 91.6 million head in 2024. From 2025 to 2032 the USDA expect the herd to grow, but only back to levels seen in 2020.

What does it mean?

A declining US herd is likely more to do with expensive feed grain and poor pasture conditions as the US moves toward 2023. A declining herd is not great for Australian lean beef export prices, as it implies cow slaughter is high, with domestic lean beef competing with Australia’s.

In the medium and long term however, the US herd bottoming out, and then rising should increase demand for Australian beef while the US herd grows. Even out to 2032 it doesn’t look like the US will be providing much more beef than present, and we know how the market is playing out now.

Key Points

- The US cattle herd has been falling for two years, and is expected to decline further.

- After bottoming out in 2024, the US herd is expected to grow out to 2032.

- A falling US herd is a little negative for Aussie beef demand, but growth should add demand.

Click on figure to expand

Data sources: USDA