The strength of fine merino prices in January have continued on their trend which began in mid-2019. The old saw says that a picture is worth a thousand words, so in this article we look at various micron curves in graphic form.

Mecardo last looked at the merino micron price curve in depth recently in (view article here), so there is no need to revisit the material covered in that article. In this article the base merino micron curve used is derived from the average price of combing length merino fleece which has a staple strength of 30 N/ktx and greater, vegetable fault below 2% and no subjective faults such as cott or colour.

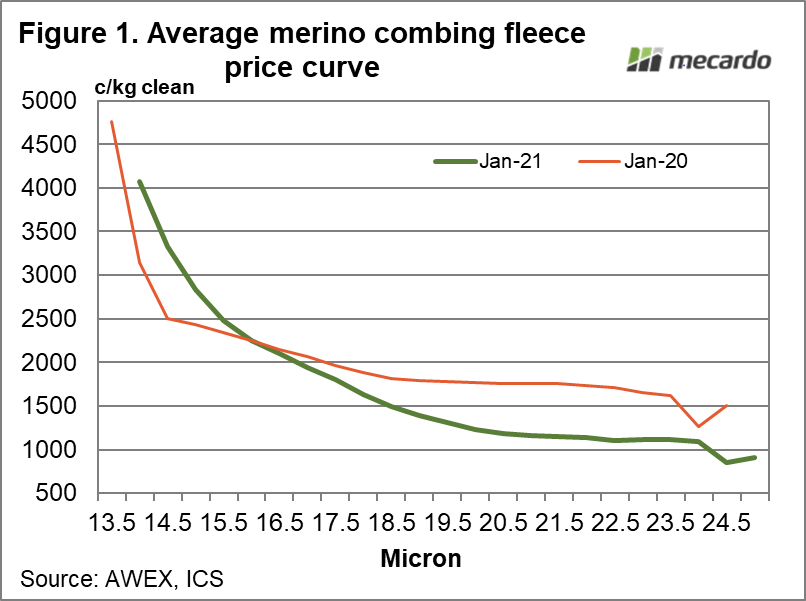

To put January 2021 prices in context Figure 1 compares the merino micron curve for the month to date with the curve from January 2020 (pre-COVID). The 2021 micron prices run from 14.0 to 25 micron. Note how 16 micron prices are currently on par with early 2020 level and price finer than 16 micron are above early 2020 levels. On the broader side of 16 micron the reverse applies, with the drop in price increasing as the micron broadens.

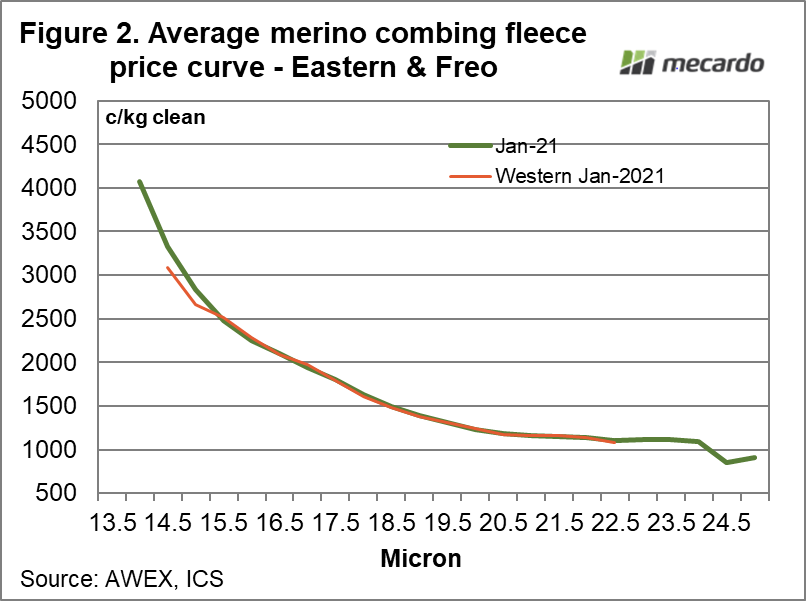

In Figure 2 the average merino combing length price is compared between eastern Australia and Fremantle for the current month. It is difficult to pick a difference, and on a simple average across the micron categories there is no effective difference in price. Even the fine end of the merino micron range in Fremantle is tracking the eastern values, rather than being heavily discounted.

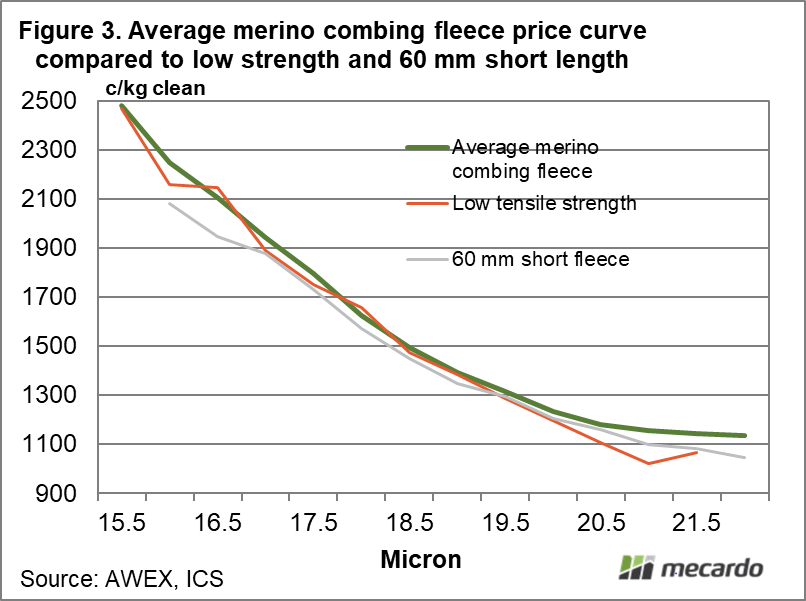

The next graphic in Figure 3 compares the eastern average merino combing fleece price with a price series for low tensile strength fleece (20 N/ktx and low staple strength) and a short length series (58-63 mm greasy staple length) for the month to date. The series run from 15.5 through to 22 micron. Once again there is little difference between the series. The simple average difference across the micron ranges for the low tensile strength fleece is a discount of 2.5% and for the 60 mm short length fleece a discount of 4.5%. The benefit of the higher fine micron premiums are being spread around a wide range of wool types rather than being focussed on a narrow band of specialty eastern spinner types.

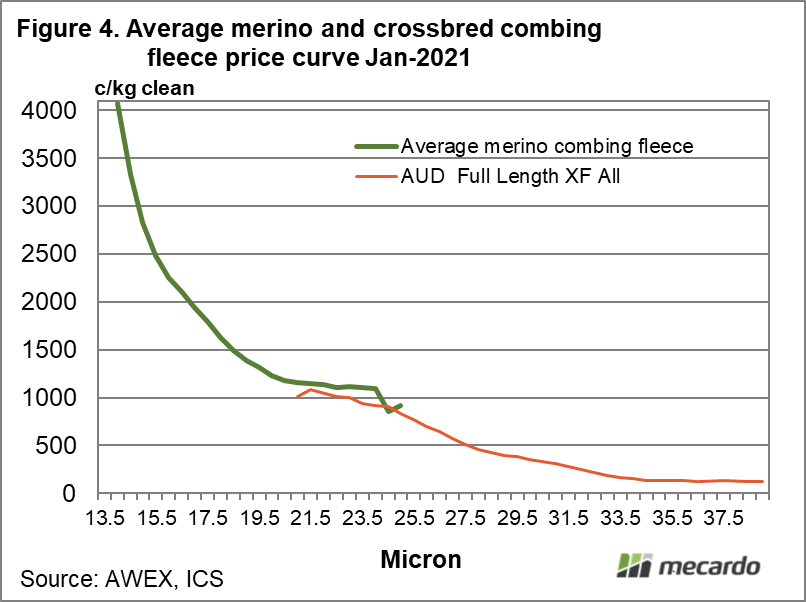

The final graphic puts the average merino combing fleece prices series together with an average crossbred combing length fleece prices series, again for the month to date. Where the two series crossover (21 through 25 micron) the crossbred series is around 10% below the merino series which looks to be a standard discount. The crossbred series runs out as far as 39 micron, where the price is averaging 121 cents for the month to date. It is not a good time for crossbred wool, although the trap in saying that is crossbred wool series shown here encompasses a wide range of micron categories and quality levels. Wools ain’t wools.

What does it mean?

Demand for fine merino wool looks to be primarily coming from the knitwear sector as there is little discount for either low staple strength or short staple length. The corollary to this is that there are minimal high staple strength premiums operating in the market. This means the benefit from higher fine merinos is being spread around, to varying types, east and west.

Have any questions or comments?

Key Points

- Increased fine merino premiums have lifted sub-16 micron prices above year ago levels.

- The price strength seen in standard fine merino fleece prices is also operating in low tensile strength and short staple length fine merino wool.

- Fremantle merino prices in January have, on average, been on par with eastern prices.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: AWEX, ICS, Mecardo